Prevention alerts are a chargeback management tool that give you 24-72 hours to resolve customer disputes before they become chargebacks — protecting your revenue and merchant accounts. These early warning systems can prevent 30-40% of chargebacks from happening, making them essential protection for maintaining healthy payment processing relationships and avoiding costly monitoring programs.

Check out our detailed overview of this chargeback prevention technique.

Definition & explanation

What are chargeback prevention alerts?

A prevention alert allows you, the merchant, to resolve a customer’s payment dispute before it progresses to a chargeback by refunding the disputed transaction.

Think of a prevention alert as one of those red, flashing sirens that warns you when something has gone wrong.

And by “gone wrong,” we mean a transaction you processed has been disputed.

Just like any other situation where sirens are going off, you have two choices:

Ignore the warning and take your chances

If you receive an alert and do nothing, the dispute will advance to a chargeback.

Try to resolve the issue before it gets worse

If you heed the warning, you can try to solve the problem and stop the chargeback.

These early warning systems pause disputes before they become chargebacks, giving you crucial time to act. Unlike fighting chargebacks after they happen (which can take weeks and may result in losses), prevention alerts use a refund-to-prevent approach. When a customer disputes a transaction, instead of immediately filing a chargeback, the bank pauses the dispute process and issues an alert. This gives you the opportunity to resolve the issue — usually through a refund — before it escalates into a formal chargeback.

Key benefits of chargeback prevention alerts

Why should I care about prevention alerts?

What are the benefits of prevention alerts? Why should you consider adding them to your chargeback prevention strategy?

Here is a high-level overview of what you could gain.

- Lower chargeback rates. This first benefit is usually the biggest and most obvious draw. If you can stop chargebacks from happening, you’ll help improve the reputation of your business and enjoy more stable, reliable payment processing.

- Solve problems quicker. A lesser known benefit of alerts is the gift of time. Chargeback notices usually take 2-5 weeks to reach you. But alert notifications happen in near real time. So you can identify and solve the underlying reason for disputes much faster, helping to eliminate future chargebacks that would otherwise be inevitable.

- Save the cost of goods. Again, alert notices come in quickly. Sometimes, they are quick enough to stop order fulfillment before your valuable merchandise is shipped out to fraudsters.

These three core benefits translate directly to business growth enablement. Maintaining healthy chargeback ratios below the critical 0.5-1% threshold can open doors to more merchant accounts, international expansion opportunities, and new sales methods that typically carry higher risk. Prevention alerts help you maintain ratios which can keep you off monitoring programs and in good standing with payment processors.

RELATED READING

Prevention alerts can help lower your VAMP ratio — one of the thresholds associated with the all-new Visa Acquirer Monitoring Program. Check our detailed guide to learn more.

How merchant chargeback prevention software works

How do alerts work?

Prevention alerts work in sort of a down-and-back relay race.

Here’s the “down” portion of the relay:

STEP #1: The transaction is disputed. Either the bank detects fraud or the cardholder reports a problem.

STEP #2: Instead of immediately filing a chargeback, the bank pauses the dispute process and issues an alert.

STEP #3: You receive the alert. While the dispute is paused (24-72 hours), you investigate the case. Usually, you’ll discover one of two things.

- The transaction has already been refunded so a chargeback isn’t needed.

- The transaction should be refunded to stop the chargeback from happening.

Of course, there is always the option to ignore the alert and take your chances with a chargeback. But this option is very rarely used. Prevention alerts come with a fee. It’s unlikely that you’d want to pay for a service and not use it.

Now, here’s the “back” portion of the relay:

STEP #4: You respond to the alert and give the bank an update. The most common response options are that you issued the refund after being notified or perhaps the transaction had already been refunded.

STEP #5: The bank receives the alert response. The dispute will be dismissed without advancing to a chargeback.

STEP #6: The cardholder’s account is credited via the refund you issued. The case is considered closed.

Here’s a simplified visual of the down-and-back process.

AltoPay provides both manual and automated management options, ensuring you never miss the critical response window. Our automation can locate the disputed transaction in your CRM, issue the refund, and respond to the alert — all without manual intervention. Check our integration guide to learn more.

The prevention alert timeline

Understanding alert timing is crucial for effective chargeback prevention.

Alert notifications arrive in near real-time when a dispute is initiated, compared to 2-5 weeks for traditional chargeback notices. By then, merchandise is shipped, revenue is lost, and your chargeback ratio is impacted.

Prevention alerts give you the gift of time to solve problems before they escalate.

However, these perks come with one particular drawback: tight timelines.

One of the primary intentions of prevention alerts is to help you avoid chargebacks. However, if certain steps aren’t taken, the alert won’t successfully resolve the dispute.

The two essential tasks are:

- Issuing the refund.

- Responding to the alert.

Both actions need to happen as soon as possible. An alert will only pause the dispute for 24-72 hours (depending on the type of alert you receive). You need to both refund and respond within that time limit.

RELATED READING

Want to take a deep dive into all the nuances of the prevention alert process? Check our more detailed guide.

Prevention alert networks: Ethoca and Verifi CDRN

Are there different types of alerts?

Prevention alert solutions are provided by two different vendors:

The alert functionality is basically the same for both vendors. There are a few small differences that you should be aware of if you decide to use prevention alerts to protect your business.

Ethoca was acquired by Mastercard, so about 60% of Ethoca alerts are for Mastercard transactions. Ethoca handles disputes globally with particularly strong coverage in Canada, Europe, and Asia.

Verifi was acquired by Visa, so approximately 75% of CDRN alerts are for Visa transactions. As a U.S.-based company, Verifi has the strongest coverage in the United States.

Check our detailed guide to learn about other similarities and differences.

RELATED READING

Coverage and integration options

Here are a couple high-level things to know about the two vendors.

- Coverage extends beyond just Visa and Mastercard — some American Express and Discover disputes are also covered through these networks, providing comprehensive protection across all major card brands.

- You can and probably should receive alerts from both Ethoca and Verifi. It’s not an either-or decision. Using multiple solutions means you have multiple layers of protection.

- You can go directly to Ethoca and/or Verifi to receive prevention alerts — but you don’t have to. Ethoca and Verifi have partnered with solution providers — like AltoPay® — to help customers get better results from their networks. The main reasons are: you can get alerts from both vendors in a single platform, you’ll have access to more data, you have the ability to automate the workflow, you can optimise your alerts, and you can get advice on how to improve your outcomes. Check our article to learn more about the perks of working with a qualified reseller.

RELATED READING

Industries and use cases

How do I know if alerts are a good fit for my business?

There are dozens of tools and hundreds of techniques to prevent chargebacks. Are prevention alerts right for your business?

Any online business can benefit from prevention alerts. But there are a couple business types and industries that can benefit the most. If any of these characteristics apply to you, you will probably want to at least consider using prevention alerts.

- You sell (or want to sell) internationally. Each individual market has its own unique risks and challenges. Prevention alerts can help level the playing field and add a universal layer of protection.

- You sell physical goods. When a chargeback is filed, it usually takes 2-5 weeks for the notification to reach your desk. A lot can happen during that time — including order fulfillment. But alert notifications happen in near real time. So you could potentially stop shipments before merchandise is sent out to fraudsters, saving you the cost of goods.

- You sell goods or services with a free trial option. Offering a free trial is a great way to increase conversions and make more sales. However, they typically lead to a higher-than-average chargeback rate. You’ll want to proactively address the inevitable risk.

- You are (or think you will be) enrolled in a chargeback monitoring program. Card brands (Mastercard®, Visa®, etc.) set limits for how many chargebacks your business can receive in a month. If you go over that limit, you could be put into a monitoring program (which includes various penalties and fines). If you are enrolled in the program too long, your merchant account might be terminated. In these situations, you need to quickly lower chargeback activity. And prevention alerts is a proven-effective technique.

- You want more merchant accounts. When you apply for a new merchant account, you have to prove the validity of your business. One way you can do that is to add prevention alerts to the accounts you already have. Help prospective processors recognize that you can effectively manage risk.

Specific industries that benefit most include ecommerce (physical and digital goods sellers), subscriptions (SaaS, membership sites, recurring billing), travel and hospitality (hotels, airlines, travel agencies), digital services (online courses, software, consulting), and other high-risk verticals (nutraceuticals, CBD, adult products, etc.). Prevention alerts are particularly effective at resolving friendly fraud and customer confusion disputes — the sources of the majority of chargebacks for most merchants.

RELATED READING

Prevention Alerts vs. RDR: Understanding your options

What’s the difference between prevention alerts and RDR?

There are several chargeback prevention technologies on the market today. Alerts are one of the oldest and probably most well-known options. A newer and quite similar technology is Rapid Dispute Resolution (RDR).

Both tools allow disputed transactions to be refunded to avoid chargebacks. However the way they go about doing that is slightly different.

Here’s an overview of the two, their differences, and how they can be used together for more complete protection.

Factor

Prevention Alerts

RDR

Card brand

Mostly Visa and Mastercard, some American Express and Discover.

Visa only

Solution provider

You can receive alerts directly from the vendor, but the features and reporting are limited. Alerts via a solution provider are more robust.

You can receive RDR directly from some acquirers, but the features and reporting are limited. RDR via a solution provider is more robust.

Process

The cardholder’s bank issues an alert. Your solution provider receives the alert. You or your solution provider issues a refund and responds within 24-72 hours.

The cardholder’s bank initiates a dispute that triggers RDR. Visa receives the case and consults your pre-set rules. If rules apply, the disputed transaction is refunded.

Rules

You decide on a case by case basis what should and shouldn’t be refunded.

You set rules for what should and shouldn’t be refunded. For example, all disputes with reason code 10.4 or anything under $50.

Source

You or your solution provider manages refunds in your CRM or order management system.

Your acquirer refunds disputes directly from your merchant account.

Automation

Some solution providers can automate the process – such as locating the disputed transaction in your CRM, issuing the refund, and responding to the alert.

Your acquirer can automatically issue a refund.

Reconciliation

Since refunds are managed in your CRM or order management system, no additional reconciliation tasks are required.

Since refunds are managed through your merchant account, you need to update your CRM to note the dispute and refund.

Results

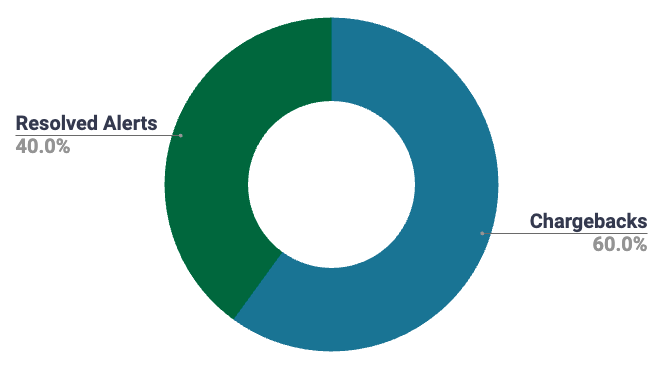

Prevention alerts typically prevent 30-40% of all chargebacks. Results improve as more banks adopt the technology.

Because RDR is integrated with all Visa issuers, the product is technically capable of preventing all chargebacks if you set your rules to refund everything. However, some banks haven’t fully adopted RDR, so results are usually around 90% of all Visa disputes.

Card brand

Prevention Alerts

Mostly Visa and Mastercard, some American Express and Discover.

RDR

Visa only

Solution provider

Prevention Alerts

You can receive alerts directly from the vendor or from a solution provider.

RDR

You can receive RDR directly from your acquirer or via a solution provider.

Process

Prevention Alerts

The cardholder’s bank issues an alert. Your solution provider receives the alert. You or your solution provider issues a refund and responds within 24-72 hours.

RDR

The cardholder’s bank initiates RDR. Your acquiring bank receives the RDR case and consults your pre-set rules. If rules apply, the acquirer issues a real-time refund.

Rules

Prevention Alerts

You decide on a case by case basis what should and shouldn’t be refunded.

RDR

You set rules for what should and shouldn’t be refunded. For example, all disputes with reason code 10.4 or anything under $50.

Source

Prevention Alerts

You or your solution provider manages refunds in your CRM or order management system.

RDR

Your acquirer refunds disputes directly from your merchant account.

Automation

Prevention Alerts

Some solution providers can automate the process – such as locating the disputed transaction in your CRM, issuing the refund, and responding to the alert.

RDR

Your acquirer can automatically issue a refund.

Results

Prevention Alerts

Prevention alerts typically prevent 30-40% of all chargebacks. Results improve as more banks adopt the technology.

RDR

Because RDR is integrated with all Visa issuers, the product is technically capable of preventing all chargebacks if you set your rules to refund everything. However, some banks haven’t fully adopted RDR, so results are usually around 90%.

Reconciliation

Prevention Alerts

Since refunds are managed in your CRM or order management system, no additional reconciliation tasks are required.

RDR

Since refunds are managed through your merchant account, you need to update your CRM to note the dispute and refund.

Both solutions work together as complementary parts of a comprehensive chargeback prevention strategy. AltoPay can help you determine the optimal mix for your business.

RELATED READING

Financial ROI and cost savings

How much do prevention alerts cost?

Prevention alert pricing is set by the vendor that provides the solution (Ethoca or Verifi). Pricing is per alert and is usually in the $20-40 range.

A couple things to note about pricing:

- The price may seem high, but alerts probably cost less than your chargeback fee. The difference is that you are paying for the alert fee instead of a chargeback fee since you are avoiding the chargeback. Aside from potentially saving money on chargeback fees, what you are getting is the gift of time and a healthy chargeback ratio — both of which are usually pretty valuable features!

- It’s not usually cheaper to go directly to Ethoca or Verifi instead of a solution provider. The price should be the same. And if you work with a solution provider, you’ll receive reporting, automation, and support — which is essentially free.

- If you refund a disputed transaction via an alert but still receive a chargeback, you’re entitled to a credit. So you basically have guaranteed success (if you use the right solution provider!).

- The old expression, “you get what you pay for,” is true. There are solution providers out there with super low pricing. But they offer very little to no support. Ultimately, you’ll pay less for each individual alert, but you’ll get way more alerts than you should.

- As you consider pricing, also consider contract terms. We recommend you work with a solution provider that doesn’t require a long-term contract. If alerts end up not being a good fit for your business or you don’t like the level of support being offered, you’ll want the ability to make changes. Don’t lock yourself into a long-term, bad situation just because pricing seems more appealing. If a service provider does require a long-term contract, there is probably a reason. Providers with a great product and support don’t need to force their customers to stick around!

Check our guide to learn more about alert pricing.

RELATED READING

The AltoPay difference

Why choose AltoPay for chargeback prevention alerts

When it comes time to choose a solution provider for your chargeback prevention alerts, you have options. But not all options are the same.

Here’s what makes AltoPay different.

- Ethoca’s longest standing partner and Verifi’s first ever partner

- Competitive pricing

- No long-term contracts

- No monthly minimums

- Global reach with local support

- Accurate, helpful information

- On-demand support from actual humans who have decades of experience

- Automation for time-consuming, labor-intensive tasks

- Plug-n-play integrations with most commonly used CRMs and gateways

- In-depth reporting and analytics (including TC40s)

- Money-back guarantee — only pay for successful alerts

- Former merchants, chargeback management veterans, and payment professionals who understand what you are looking for

Contact our team today if you’d like to learn more.

Getting started with prevention alert services

Our simple 3-step onboarding process can start protecting your business within 24 hours. Here’s how it works.

- Fill out our online form and provide basic business information.

- Meet with our team so we can help you build a customised strategy that is optimised for ROI. Want to get up and running within 24 hours? Come prepared with your billing descriptors, merchant account details, and the name of your CRM or order management system.

- We’ll activate your protection to start receiving and preventing chargebacks.

Questions and answers

Frequently asked questions about prevention alerts

How quickly do chargeback prevention alerts work?

Alerts arrive in near real-time when a dispute is initiated, compared to 2-5 weeks for traditional chargeback notices. Once you’ve signed up with AltoPay, activation typically takes 24 hours, and you’ll see immediate impact as soon as the tool is active.

What’s the difference between Ethoca and Verifi alerts?

There are several differences between Ethoca and Verifi. Here are a couple that are most commonly discussed.

- Card brand coverage – Ethoca covers slightly more Mastercard disputes and Verifi covers slightly more Visa disputes.

- Geographical coverage – Ethoca works with slightly more international issuing banks while Verifi works with slightly more U.S. issuing banks

- Dispute types – Ethoca originally intended to address legitimate card fraud while Verifi wanted to address non-fraud cardholder disputes.

- Time limits – Ethoca responses have to be received within 24 hours but Verifi allows up to 72 hours.

Each network has its own strengths, which is why we recommend using both for optimal 30-40% prevention rates.

Check our detailed guide for a complete overview of Ethoca vs. Verifi.

Will I get an alert for every disputed transaction?

Prevention alerts can help you resolve some — but not all — disputes. Some cases will still advance to chargebacks.

These are the most common reasons why.

- The cardholder’s bank isn’t integrated with prevention alert technology.

- You aren’t able to issue a refund (for example, if your merchant account has been closed or you can’t match the alert to the original transaction).

Check our related article to learn more.

RELATED READING

Usually, merchants who use both Ethoca and Verifi alerts are able to prevent about 30-40% of disputes from becoming chargebacks.

Do prevention alerts work for all types of disputes?

Yes. Prevention alerts can help resolve all types of disputes — merchant error, criminal fraud, and friendly fraud.

They are especially helpful in cases of criminal fraud. Criminal fraud is usually detected and reported quickly. Since alerts are issued in near real time, you can potentially stop order fulfillment before the criminal gets access to your merchandise.

Next steps

If you are ready to get started with prevention alerts, let us know. We can usually onboard new merchants in about 24 hours.

If you’re still trying to decide if alerts are a good fit for your business, check our additional resources.

- 3 Integration Options for Prevention Alerts

- Ethoca vs. Verifi: How Do the Prevention Alerts Compare?

- Why Would I Get Alerts From AltoPay Instead of Ethoca or Verifi?

- Why Can’t I Prevent All Chargebacks with Alerts?

- What are the Pros and Cons of Prevention Alerts?

- Chargeback Prevention: Alerts vs. RDR

- How Much Do Prevention Alerts Cost?

AUTHOR

Jessica Velasco

For more than a decade, Jessica Velasco has been a thought leader in the payments industry. She aims to provide readers with valuable, easy-to-understand resources.