There are many different factors that go into a comprehensive chargeback prevention strategy. In fact, we have a detailed guide that outlines all the various elements — data analysis, business processes, customer service policies, third-party products, and much more.

But there are a couple tools in particular that are especially effective: prevention alerts and prevention RDR.

Let’s take a look at how these tools work, the differences between the two, which would be best for your business, and how to incorporate them into a comprehensive strategy.

NOTE

Unfortunately, there isn’t a universal language for payment processing. Terminology and definitions can vary significantly from one person to the next.

At AltoPay®, we’ve adopted a classification system that aligns with the card brands (Mastercard, Visa, etc.) and many other service providers — while still being easy to understand.

Here’s what we’ve come up with.

The invention of chargeback prevention solutions

In a perfect world, you would provide a fantastic experience that leaves all your customers completely satisfied. If a customer doesn’t have a great experience, then that person would tell you about the problem so you can fix it.

But as we all know, reality rarely matches the ideal situation. Sometimes customers are unsatisfied — and they contact the bank instead of you.

That’s when chargebacks happen.

If you get too many chargebacks, there are consequences. So various industry members have come up with ways to resolve payment issues without chargebacks — even if customers go to their bank instead of you.

Here’s a list of some of the most commonly implemented solutions for dispute resolution:

- Order Insight

- Consumer Clarity

- Ethoca alerts

- Verifi Cardholder Dispute Resolution Network (CDRN)

- Rapid Dispute Resolution (RDR)

Of those, Ethoca alerts, Verifi CDRN, and RDR are currently the most popular. They are easy to implement and have a proven record of success.

Let’s take a look at how they can be used to prevent chargebacks.

What are prevention alerts and prevention RDR?

NOTE

We use the term ‘prevention alerts’ to collectively refer to Ethoca alerts and Verifi CDRN. Ethoca and Verifi are two different solution providers. However, because there are so many commonalities between Ethoca alerts and Verifi CDRN, we refer to them as a single entity.

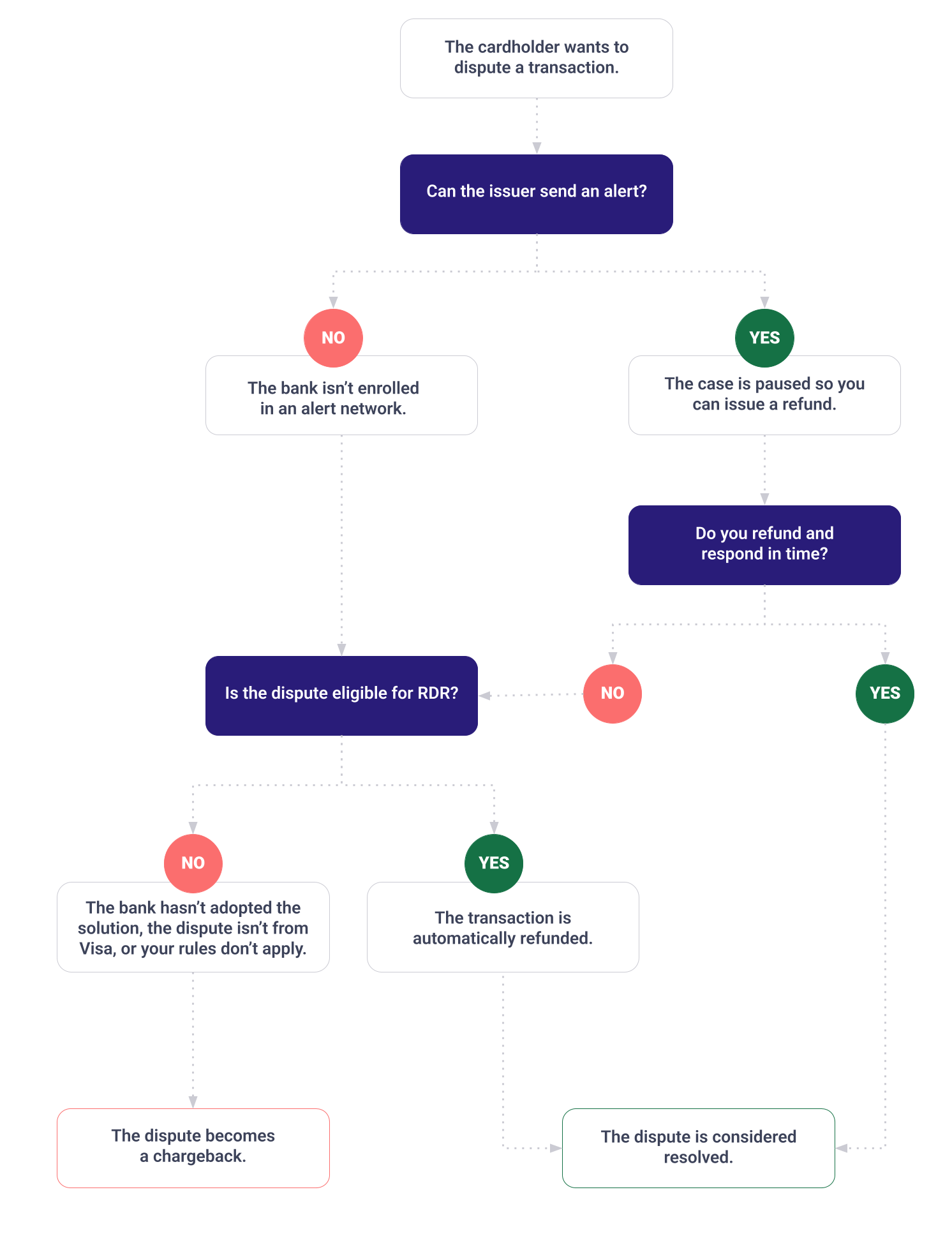

Prevention alerts and prevention RDR intercept payment disputes before they turn into chargebacks. By interrupting the chargeback process, these solutions give you a chance to refund the disputed transaction to resolve a customer’s complaint.

While prevention alerts and prevention RDR achieve the same outcome, the way they go about doing it is slightly different.

How do prevention alerts and prevention RDR work?

There are a couple different integration options for both solutions. We’ll explain how alerts and RDR work with the most cost-effective and efficient option — full automation via AltoPay.

How do prevention alerts work?

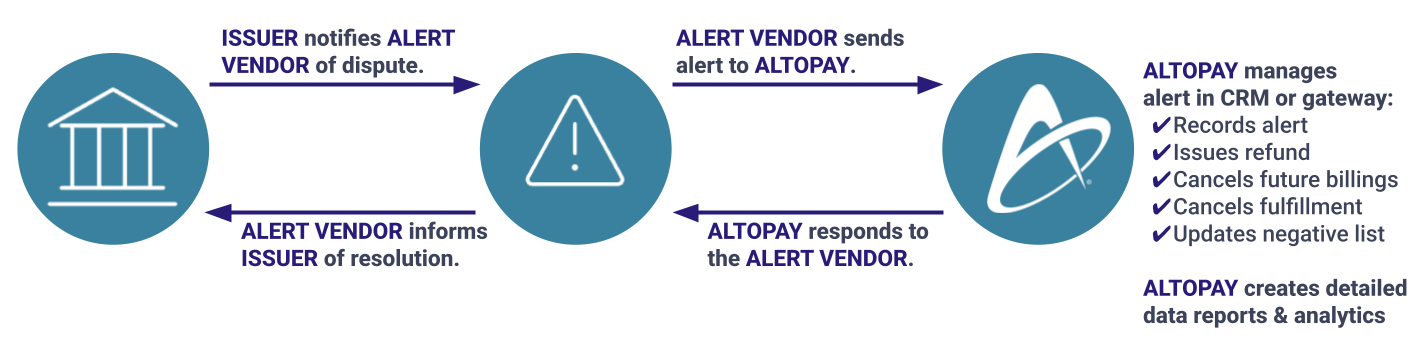

When a transaction is disputed, the issuing bank — if integrated with an alert vendor — can send an alert instead of a chargeback.

AltoPay will receive the alert on your behalf. We’ll refund the transaction, update your CRM, and respond to the alert vendor. We’ll also add the case to our detailed reports in the AltoPay platform.

The alert vendor will notify the issuer that the dispute has been resolved and a chargeback is not necessary.

The entire process works like this:

How does prevention RDR work?

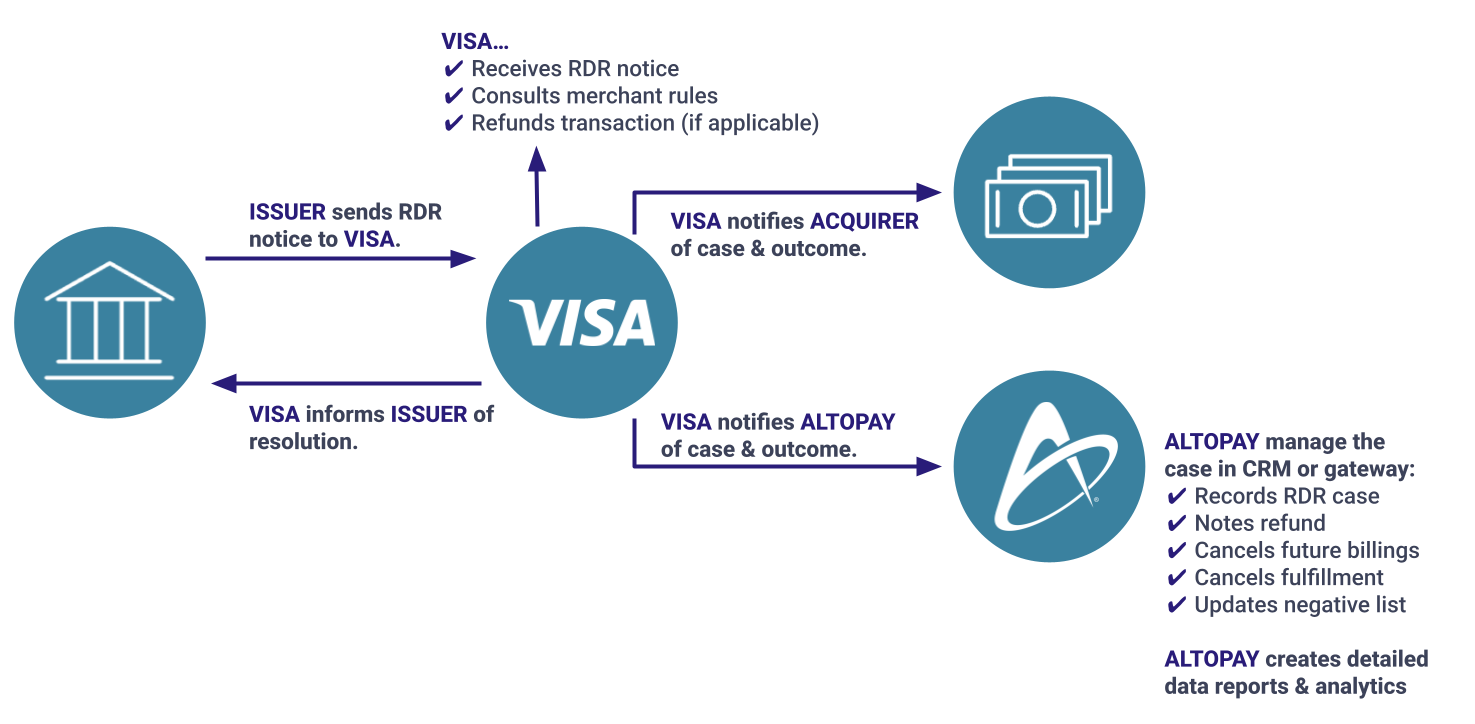

When an issuer files a Visa dispute, the case is intercepted by RDR. Visa will consult your preset rules. If rules apply, your merchant account will be debited and the transaction refunded.

Visa will let both your acquirer and AltoPay know about the RDR case.

Upon receiving the notice, AltoPay will update your CRM, note the RDR case, and add the case to the detailed reporting in our platform.

An overview of two chargeback prevention solutions

Let’s take a look at a high-level overview of prevention alerts and prevention RDR.

Card brand

Prevention alerts

Prevention alerts are primarily used to manage Visa and Mastercard disputes. They can also help prevent a small portion of American Express and Discover chargebacks.

Prevention RDR

RDR is a Visa product and can only be used to manage Visa disputes.

Solution provider

Prevention alerts

You can receive alerts directly from the vendor (Ethoca and/or Verifi). However, integration via a solution provider is a more robust option — more data, reporting, features, and support. (Check our integration comparison to learn why.)

Prevention RDR

You can receive RDR directly from some acquirers. However, integration via a solution provider is a more robust option — more data, reporting, features, and support.

Process

Prevention alerts

If the issuing bank is integrated with an alert vendor, an alert is sent when a transaction is disputed. You or your solution provider refunds the transaction and responds within 24-72 hours.

Prevention RDR

The issuing bank initiates a dispute that triggers RDR. Visa reviews your pre-set RDR rules. If the rules apply, your merchant account is debited and the transaction refunded.

Rules

Prevention alerts

Whether or not you refund a transaction is usually decided on a case by case basis.

However, depending on which vendor you use, you may be able to set rules like, “don’t issue an alert for disputes over $200” or “don’t issue an alert if the transaction was processed more than 100 days prior”.

Prevention RDR

You set rules to tell Visa whether or not a transaction should be refunded. For example, refund anything under $10 or classified as fraud.

Sources of refund

Prevention alerts

You or your solution provider issue refunds from your CRM or order management system.

Prevention RDR

Visa refunds disputes directly from your merchant account.

Automation

Prevention alerts

Various actions must be taken for each alert that’s received.

- Locating the disputed transaction in your CRM

- Recording the alert in your CRM

- Issuing the refund

- Responding to the alert

- Cancelling future purchases (if applicable)

Some solution providers can automate the alert management process. If you don’t want to or can’t automate the alert process, you’ll have to complete the steps manually.

Prevention RDR

Visa will automatically refund the disputed transaction.

Reconciliation

Prevention alerts

Since refunds are managed in your CRM or order management system, no additional reconciliation tasks are required.

Prevention RDR

Since refunds are managed through your merchant account, you need to update your CRM to note the dispute and refund.

Results

Prevention alerts

Prevention alerts usually stop 30-40% of chargebacks. As more issuing banks adopt the technology, more chargebacks can be prevented.

Prevention RDR

All Visa issuing banks have access to the RDR platform. So technically, all Visa disputes could be resolved via RDR (if you set your rules to refund everything). However, not all banks have adopted and use RDR capabilities. So right now, merchants are able to prevent up to 90% of Visa chargebacks.

RELATED READING

Both prevention alerts and RDR can positively impact your VAMP ratio. Check our guide to learn more about potential results.

Card brand

Prevention alerts

Prevention alerts are primarily used to manage Visa and Mastercard disputes. They can also help prevent a small portion of American Express and Discover chargebacks.

Prevention RDR

RDR is a Visa product and can only be used to manage Visa disputes.

Solution provider

Prevention alerts

You can receive alerts directly from the vendor (Ethoca and/or Verifi). However, integration via a solution provider is a more robust option — more data, reporting, features, and support.

Prevention RDR

You can receive RDR directly from some acquirers. However, integration via a solution provider is a more robust option — more data, reporting, features, and support.

Process

Prevention alerts

If the issuing bank is integrated with an alert vendor, an alert is sent when a transaction is disputed. You or your solution provider refunds the transaction and responds within 24-72 hours.

Prevention RDR

The issuing bank initiates a dispute that triggers RDR. Visa reviews your pre-set RDR rules. If the rules apply, your merchant account is debited and the transaction refunded.

Rules

Prevention alerts

Whether or not you refund a transaction is usually decided on a case by case basis.

However, depending on which vendor you use, you may be able to set rules like, “don’t issue an alert for disputes over $200” or “don’t issue an alert if the transaction was processed more than 100 days prior”.

Prevention RDR

You set rules to tell Visa whether or not a transaction should be refunded. For example, refund anything under $10 or classified as fraud.

Sources of refund

Prevention alerts

You or your solution provider issue refunds from your CRM or order management system.

Prevention RDR

Visa refunds disputes directly from your merchant account.

Automation

Prevention alerts

Various actions must be taken for each alert that’s received.

- Locating the disputed transaction in your CRM

- Recording the alert in your CRM

- Issuing the refund

- Responding to the alert

- Cancelling future purchases (if applicable)

Some solution providers can automate the alert management process. If you don’t want to or can’t automate the alert process, you’ll have to complete the steps manually.

Prevention RDR

Visa will automatically refund the disputed transaction.

Reconciliation

Prevention alerts

Since refunds are managed in your CRM or order management system, no additional reconciliation tasks are required.

Prevention RDR

Since refunds are managed through your merchant account, you need to update your CRM to note the dispute and refund.

Results

Prevention alerts

Prevention alerts usually stop 30-40% of chargebacks. As more issuing banks adopt the technology, more chargebacks can be prevented.

Prevention RDR

All Visa issuing banks have access to the RDR platform. So technically, all Visa disputes could be resolved via RDR (if you set your rules to refund everything). However, not all banks have adopted and use RDR capabilities. So right now, merchants are able to prevent up to 90% of Visa chargebacks.

Which is best: alerts or RDR?

Both prevention alerts and prevention RDR have valuable benefits you don’t want to miss. These are usually the most noteworthy, but you can view a complete list of benefits here.

- Lower chargeback rates. This first benefit is usually the biggest and most obvious draw. If you can stop chargebacks from happening, you’ll help improve the reputation of your business and enjoy more stable, reliable payment processing.

- Solve problems quicker. A lesser known benefit of prevention solutions is the gift of time. Chargeback notices usually take 2-5 weeks to reach you. But alert and RDR notifications happen in near real time. So you can identify and solve the underlying reason for disputes much faster, helping to eliminate future chargebacks that would otherwise be inevitable.

- Save the cost of goods. Again, alert and RDR notices come in quickly. Sometimes, they are quick enough to stop order fulfillment before your valuable merchandise is shipped out to fraudsters.

Each solution has its own unique features, which — depending on your business — might be considered benefits.

Use prevention alerts if…

Use prevention RDR if…

- You might want the ability to review each case before a refund decision is made

- You want a solution up and running within 24 hours

- You want protection for Visa and Mastercard

- You want a fully automated resolution

- You can wait a a week or two for the integration process to be completed

- The majority of your disputes are for Visa transactions

- You are worried about your VAMP ratio

Use prevention alerts if…

- You might want the ability to review each case before a refund decision is made

- You want a solution up and running within 24 hours

- You want protection for Visa and Mastercard

Use prevention RDR if…

- You want a fully automated resolution

- You can wait a a week or two for the integration process to be completed

- The majority of your disputes are for Visa transactions

- You are worried about your VAMP ratio

Usually, there isn’t a single solution that can solve all chargeback challenges. For most merchants, a multi-layer strategy is best — using multiple solutions to resolve as many disputes as possible.

Creating a complete strategy with alerts and RDR

For most merchants, we recommend a comprehensive chargeback prevention strategy — using both alerts and RDR to minimize risk.

Here’s what that would look like.

Want to know more about prevention alerts and prevention RDR?

If you have questions about which solution to use or how to create a comprehensive strategy, let us know. AltoPay provides both solutions and can help you figure out what would be a good fit for your business.

Reach out to our team today to learn more.

For more than a decade, Jessica Velasco has been a thought leader in the payments industry. She aims to provide readers with valuable, easy-to-understand resources.