NOTE

Before we begin, we want to offer a word of caution.

By now, you’ve probably discovered that chargebacks are an unfair, costly, confusing, and labour intensive part of doing business online. Naturally, you want to avoid chargebacks whenever possible.

But don’t go overboard with your prevention strategy. If you are too aggressive, you’ll block chargebacks — and revenue.

Aim for a balanced approach. Using multiple tools and techniques at different points of the customer journey usually gives the best flexibility.

If you are struggling to find the right balance, let AltoPay help. We offer all the latest chargeback solutions — and our solutions come with decades of experience. Let our team help you create a strategy for stable payment processing. Check our chargeback prevention solutions to learn more.

Contents

- • Determine why chargebacks happen

- • Know what you can and can’t prevent

- • Reduce chargebacks with simple policy and process updates

- • Use tools to prevent fraud

- • Use tools to resolve disputes

- • Understand the impact of chargebacks

- • Measure your chargeback prevention results

- • Build a complete strategy

Figure Out Why You Are Receiving Chargebacks

Before you can prevent chargebacks, you have to know why they are happening. Then, you can put a plan in place to stop future disputes.

STEP 1

Check your reason codes.

Every chargeback is accompanied by a reason code — a description of why the cardholder’s bank (issuer) filed the dispute.

Each card brand (American Express®, Discover®, Mastercard®, and Visa®) has their own set of reason codes.

See full list

- A01 Charge Amount Exceeds Authorization Amount

- A02 No Valid Authorization

- A08 Authorization Approval Expired

- Fraud

- C02 Credit Not Processed

- C04 Goods / Services Returned or Refused

- C05 Goods / Services Cancelled

- C08 Goods / Services Not Received or Only Partially Received

- C14 Paid By Other Means

- C18 “No Show” or CARDeposit Cancelled

- C28 Cancelled Recurring Billing

- C31 Goods / Services Not As Described

- C32 Goods / Services Damaged Or Defective

- Authorization

- F10 Missing Imprint

- F24 No Cardmember Authorization

- F29 Card Not Present

- F30 EMV Counterfeit

- F31 EMV Lost / Stolen / Non-Received

- Processing Error

- M01 Chargeback Authorization

- P01 Unassigned Card Number

- P03 Credit Processed as Charge

- P04 Charge Processed As Credit

- P05 Incorrect Charge Amount

- P07 Late Submission

- P08 Duplicate Charge

- P22 Non-Matching Card Number

- P23 Currency Discrepancy

- Inquiry/Miscellaneous

- R03 Insufficient Reply

- R13 No Reply

See full list

- 05 Good Faith Investigation Chargeback

- AA Does Not Recognize

- AP Recurring Payments

- AT Authorization Noncompliance

- AW Altered Amount

- CD Credit / Debit Posted Incorrectly

- DP Duplicate Processing

- IN Invalid Card Number

- LP Late Presentation

- NF Non-Receipt of Cash from an ATM

- PM Paid by Other Means

- RG Non-Receipt of Goods, Services, or Cash

- RM Cardholder Disputes the Quality of Goods or Services

- RN2 Credit Not Processed

- Fraud

- UA01 Fraud: Card Present Transaction

- UA02 Fraud: Card Not Present Transaction

- UA05 Fraud: Chip Card Counterfeit Transaction

- UA06 Fraud: Chip and PIN Transaction

- Processing Error

See full list

- 4807 Warning Bulletin

- 4808 Authorization-Related Chargeback

- 4812 Account Number Not on File

- 4831 Transaction Amount Differs

- 4834 Point-of-Interaction Error

- 4837 No Cardholder Authorization

- 4841 Cancelled Recurring or Digital Goods Transactions

- 4846 Correct Transaction Currency Code Not Provided

- 4849 Questionable Merchant Activity

- 4853 Cardholder Dispute

- 4855 Goods or Services Not Provided

- 4859 Addendum, No-show, or ATM Dispute

- 4860 Credit Not Processed

- 4870 Chip Liability Shift

- 4871 Chip Liability Shift-Lost/Stolen/Never Received Issue (NRI) Fraud

See full list

- 10.1 EMV Liability Shift Counterfeit Fraud

- 10.2 EMV Liability Shift Non-Counterfeit Fraud

- 10.3 Other Fraud – Card-Present Environment

- 10.4 Other Fraud – Card-Absent Environment

- 10.5 Visa Fraud Monitoring Program

- 11.1 Card Recovery Bulletin

- 11.2 Declined Authorization

- 11.3 No Authorization/Late Presentment

- 12.2 Incorrect Transaction Code

- 12.3 Incorrect Currency

- 12.4 Incorrect Account Number

- 12.5 Incorrect Amount

- 12.6 Duplicate Processing

- 12.6 Paid by Other Means

- 12.7 Invalid Data

- 13.1 Merchandise/Services Not Received

- 13.2 Cancelled Recurring Transaction

- 13.3 Not as Described or Defective Merchandise/Services

- 13.4 Counterfeit Merchandise

- 13.5 Misrepresentation

- 13.6 Credit Not Processed

- 13.7 Cancelled Merchandise/Services

- 13.8 Original Credit Transaction Not Accepted

- 13.9 Non-Receipt of Cash at an ATM

Go back through the chargeback notices you have received over the last 3-6 months. Make a note of the reason code for each.

STEP 2

Consolidate your data.

Once you have a list of your most common reason codes, you’ll want to consolidate and condense everything.

The card brands each have their own codes, but they all lump those codes into four general categories.

Fraud

- F10 Missing Imprint

- F24 No Cardmember Authorization

- F29 Card Not Present

- F30 EMV Counterfeit

- F31 EMV Lost / Stolen / Non-Received

Discover

- UA01 Fraud: Card Present Transaction

- UA02 Fraud: Card Not Present Transaction

- UA05 Fraud: Chip Card Counterfeit Transaction

- UA06 Fraud: Chip and PIN Transfer action

Mastercard

- 4837 No Cardholder Authorization

- 4849 Questionable Merchant Activity

- 4870 Chip Liability Shift

- 4871 Chip Liability

Visa

- 10.1 EMV Liability Shift Counterfeit Fraud

- 10.2 EMV Liability Shift Non-Counterfeit Fraud

- 10.3 Other Fraud – Card-Present Environment

- 10.4 Other Fraud – Card-Absent Environment

- 10.5 Visa Fraud Monitoring Program

Authorization

- A01 Charge Amount Exceeds Authorization Amount

- A02 No Valid Authorization

- A08 Authorization Approval Expired

Mastercard

- 4807 Warning Bulletin

- 4808 Authorization-Related Chargeback

- 4812 Account Number Not on File

Visa

- 11.1 Card Recovery Bulletin

- 11.2 Declined Authorization

- 11.3 No Authorization/Late Presentment

Processing Error

- P01 Unassigned Card Number

- P03 Credit Processed as Charge

- P04 Charge Processed As Credit

- P05 Incorrect Charge Amount

- P07 Late Submission

- P08 Duplicate Charge

- P22 Non-Matching Card Number

- P23 Currency Discrepancy

Discover

- AT Authorization Noncompliance

- IN Invalid Card Number

- LP Late Presentation

Mastercard

- 4831 Transaction Amount Differs

- 4834 Point-of-Interaction Error

- 4841 Cancelled Recurring or Digital Goods Transactions

- 4842 Late Presentment

- 4846 Correct Transaction Currency Code Not Provided

Visa

- 12.2 Incorrect Transaction Code

- 12.3 Incorrect Currency

- 12.4 Incorrect Account Number

- 12.5 Incorrect Amount

- 12.6 Duplicate Processing

- 12.6 Paid by Other Means

- 12.7 Invalid Data

Cardholder Dispute

- C02 Credit Not Processed

- C04 Goods / Services Returned or Refused

- C05 Goods / Services Cancelled

- C08 Goods / Services Not Received or Only Partially Received

- C14 Paid By Other Means

- C18 “No Show” or CARDeposit Cancelled

- C28 Cancelled Recurring Billing

- C31 Goods / Services Not As Described

- C32 Goods / Services Damaged Or Defective

Discover

- 05 Good Faith Investigation Chargeback

- AA Does Not Recognize

- AP Recurring Payments

- AW Altered Amount

- CD Credit / Debit Posted Incorrectly

- DP Duplicate Processing

- NF Non-Receipt of Cash from an ATM

- PM Paid by Other Means

- RG Non-Receipt of Goods, Services, or Cash

- RM Cardholder Disputes the Quality of Goods or Services

- RN2 Credit Not Processed

Mastercard

- 4853 Cardholder Dispute

- 4855 Goods or Services Not Provided

- 4859 Addendum, No-show, or ATM Dispute

- 4860 Credit Not Processed

Visa

- 13.1 Merchandise/Services Not Received

- 13.2 Cancelled Recurring Transaction

- 13.3 Not as Described or Defective Merchandise/Services

- 13.4 Counterfeit Merchandise

- 13.5 Misrepresentation

- 13.6 Credit Not Processed

- 13.7 Cancelled Merchandise/Services

- 13.8 Original Credit Transaction Not Accepted

- 13.9 Non-Receipt of Cash at an ATM

For example, American Express code C28 Cancelled Recurring Billing and Visa code 13.2 Cancelled Recurring Transaction are both cases of a cardholder dispute.

These broad categories can help you start to narrow down your strategy.

For example, if 90% of reason codes are fraud related and 10% are cardholder disputes, you don’t even need to worry about preventing authorization and processing error disputes.

STEP 3

Determine the underlying causes.

A reason code gives you a good idea of why the bank thinks a transaction should be disputed.

But it doesn’t tell you a cardholder’s underlying motive.

To get that information, you’ll need to drill down to the real reason for chargebacks. We’ve identified three main causes.

- Merchant error: You made a mistake while processing the transaction.

- Criminal fraud: A fraudster used a cardholder’s account or card without permission to make an unauthorised purchase.

- Friendly fraud: The cardholder used the chargeback process incorrectly — either intentionally or because of confusion.

It’s important to gather this information because it can influence your chargeback prevention strategy.

Consider this example — a single reason code could have two different causes.

Visa 13.2 Cancelled Recurring Transaction

Merchant Error

You told the cardholder you’d cancel a subscription, but you forgot. When you didn’t follow through on your promise, the cardholder disputed the charge.

Friendly Fraud

The cardholder forgot about an upcoming charge and didn’t cancel in time. When the bill came, the cardholder regretted the expense and falsely claimed you made a mistake to recover the funds.

If the chargeback was the result of a mistake on your part, all you have to do to prevent future chargebacks is make sure your team and technology are following through on cancellation requests. But if the chargeback was a case of friendly fraud, your response would be different.

For example, maybe you need to send a reminder email before charging the card and include instructions on how to cancel.

NOTE

This step is vitally important. If you don’t know the real reason for chargebacks, you could waste a lot of time and money on the wrong prevention strategy.

But it isn’t an easy task. You have to collect, consolidate, and analyse your data — and that can be challenging if you don’t have the right technology.

If you aren’t currently working with a solution provider that can provide the data and analytics you need, now is the perfect time to get started. Check AltoPay’s chargeback management solutions to learn more.

Know What You Can and Can’t Prevent

Before you go any farther in your chargeback prevention strategy, it’s important to understand a couple limitations and realities.

First, it is impossible to completely eliminate the risk of chargebacks.

Chargebacks are a consumer protection mechanism rooted in U.S. federal law.

Any solution provider offering complete chargeback protection isn’t being fully transparent.

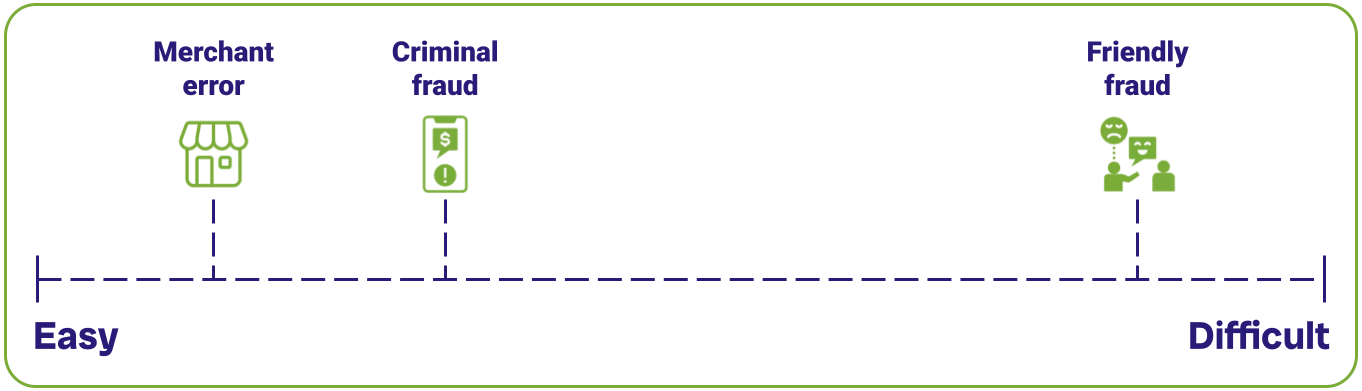

Second, some chargebacks are easier to prevent than others.

Remember our simplified classification system?

-

-

- Merchant error

- Criminal fraud

- Friendly fraud

-

If we were to place those three categories on a scale from ‘easy to prevent’ to ‘difficult to prevent’, it would look something like this:

Merchant error is pretty easy to prevent. You’ll want to continuously audit your internal processes and procedures. The fewer mistakes you make, the fewer chargebacks you’ll receive.

And with the right technology in place, criminal fraud is also relatively easy to detect and prevent. A fraud detection solution can look for common indicators of fraud and decline transactions that are likely unauthorised.

But friendly fraud is harder to prevent.

It’s more ambiguous. It can’t be traced back to an easily defined activity — like stealing a roommate’s credit card or shipping a red bag instead of a blue one.

Friendly fraud is driven by the consumer’s preferences, emotions, opinions, beliefs, morals, or fears. And those factors can fluctuate significantly by person and instance. It’s very hard to predict an action and proactively work to stop it from happening.

However, that doesn’t mean it’s impossible to manage friendly fraud.

You just have to have the right strategy in place.

Are you worried that chargebacks could be caused by unintentional mistakes? Wondering which fraud solutions would be best for your business? Struggling to keep friendly fraud in check?

AltoPay can help. Our team of experts can analyse your chargeback data, help discover the true cause of disputes, and suggest a strategy to provide the most complete protection possible.

Check our chargeback prevention page to learn how to get started.

Reduce Chargebacks With Simple Policy and Process Updates

The more complete your strategy, the more chargebacks you will prevent. And a complete strategy usually involves dozens of different management tactics, implemented at various points along the customer journey.

Some layers in a multi-layer strategy involve technology.

There are several tools that can help prevent fraud and chargebacks — and you should definitely consider using them. We’ll explain available options later in this guide.

But before you turn to outside help, see what internal updates you can make to reduce risk. There are probably dozens of small changes you can make that will have a major impact. And, most things you can do for free!

Audit your products and services.

Sell high-quality goods and services. Don’t offer subpar, damaged, or counterfeit items. Disputes are justified if you are selling items of little or no value.

Write detailed, accurate product descriptions. Be as detailed as possible. The more clarity you can provide, the less chance there is for confusion or misaligned expectations.

- If you sell physical merchandise, share details about materials used, size, and weight. Include photos of the item. Take shots from different angles. Zoom in on details.

- If you sell digital goods, mention the file size and type. Include screenshots or other tangible evidence of your merchandise.

- If you sell services, clearly outline what can be expected. Explain how and when the service will be performed.

Mentioned applicable licences and certificates. Take advantage of opportunities to prove the validity of your business. Customers may be less likely to dispute purchases if they feel you are credible.

Make sure your marketing efforts are honest. Don’t overpromise and underdeliver. That’s just asking for trouble!

Test different price points. See where the sweet spot is to balance profits with perceived value. You don’t want to charge more than the customer is willing to pay.

Look for high-risk products or services. Are some of your items more prone to chargebacks than others? Consider removing items from inventory if they cause higher-than-normal chargeback activity.

Use payment processing best practices.

Write clear billing descriptors. A billing descriptor is the short purchase explanation that appears on a cardholder’s statement or online banking portal. Make sure yours is easy to recognize.

- Your processor might automatically use your legal business name, but you want your descriptor to be your “doing business as” name. If your legal business name isn’t something your customers will recognize, ask for an edit.

- Make test purchases to ensure your billing descriptor is clear for all card brands (American Express, Discover, Mastercard, and Visa) and all card types (credit and debit).

- Use abbreviations if necessary. You don’t want critical information to be truncated. Most descriptors are only 20-25 characters long.

- If you can, include your customer service phone number in your descriptor (but only if someone is available to answer calls 24/7).

Manage currencies correctly. Always process transactions in your local currency unless the cardholder specifically asks to use a different currency. Tools like Dynamic Currency Conversion (DCC) make it possible to process in the cardholder’s currency instead of yours. However, there is usually a fee for this service. Unexpected surcharges can easily lead to disputes.

Send order confirmation emails. Once you’ve processed a transaction, immediately email the customer. This notification serves two purposes. First, cardholders can refer back to your message if they later don’t remember or recognize a charge to their account. Second, the cardholder can more easily detect accidental purchases. For example, a child might make an in-app purchase with a parent’s stored credit card. The cardholder could reach out to cancel or refund the purchase without resorting to a chargeback.

Clearly disclose subscriptions and trial offers. If you use a recurring billing model, you need to be super clear about how and when a card will be charged. Failing to share important information will understandably lead to chargebacks.

Remind customers of upcoming charges. If you use a recurring billing model, make sure customers know about upcoming charges. You might even want to include a link to your cancellation policy. If you are going to lose a customer anyway, it’s better to proactively cancel a subscription than receive a chargeback.

Ask for the expiration date. Some chargebacks are only valid if the card has expired. If you don’t request this information, the bank might not be able to block invalid disputes.

Settle transactions by the deadline. A transaction isn’t complete until it has been settled. Most businesses settle transactions immediately or in a batch at the end of the day. If you choose to prolong the settlement process, make sure you are still within card brand timelines. If you take too long to settle a transaction, it automatically qualifies for a chargeback.

Request authorization for all transactions. During the authorization process, the issuing bank will advise you to either approve or decline a transaction. Most transactions are approved, but there are a couple reasons why a purchase should be declined — for example, the cardholder’s account doesn’t have sufficient funds or the card has been reported stolen. Declining appropriate purchases can help avoid chargebacks.

Use authorization holds correctly. An authorization hold allows you to freeze funds until you can settle the transaction. This is helpful for delayed charges — like at hotels or car rental companies. But if you don’t manage the hold properly, the transaction automatically qualifies for a chargeback.

Promptly fulfil qualified refund requests. It can take a few days for a refund to reach the cardholder’s account. So make sure you act as quickly as possible. Also, tell customers when they can expect to receive the money back in their account to avoid chargebacks driven by confusion and frustration.

Look for signs of fraud. Fraud detection and prevention technology can help block unauthorised transactions that will result in chargebacks.

Check the fulfillment process.

Accurately fulfil all orders. Give customers the physical goods, digital goods, or services they ordered. This may seem obvious, but if you provide the wrong item, the customer probably won’t be happy.

Make sure your order fulfilment timelines are realistic. Take both fulfilment and shipping into account when you put timeline estimates on your website. It might be a good idea to offer a variety of shipping speeds so everyone’s expectations are met.

Don’t charge the card until the merchandise has been sent or services provided. Customers shouldn’t have to pay for something they haven’t received.

Use appropriate packing materials. Don’t let merchandise break while in transit.

Give clear access or download instructions for digital goods. Provide easy-to-understand explanations with step-by-step instructions. Frustration can cause chargebacks.

Consider providing tracking information. If the customer knows where the shipment is and when it can be expected, there is less chance of a “merchandise not received” chargeback.

Provide exceptional customer service.

Share your contact information. Provide as many contact methods as possible—phone, email, social media and even live chat—and make it easy for customers to find your contact information.”

Check call wait times. The longer someone has to wait to resolve a problem, the greater the risk of a chargeback.

Quickly respond to emails. Again, the faster you resolve an issue, the better. Make sure your responses are helpful and accurate.

Use social media for more than marketing. Social media platforms are a great way to promote your business. But customers can also use them for troubleshooting and complaints. Monitor all accounts, and promptly respond to anyone who reaches out.

Train employees. All employees from all teams can be involved in your chargeback prevention strategy. Help team members understand what’s at stake and how their individual roles play a part in your overall goals. Empower employees to be proactive problem solvers.

Write user-friendly policies.

Write policies that are easy to understand. Avoid jargon and unnecessarily complex processes. You want people to work with you versus filing a chargeback with the bank. Be as user-friendly as possible.

Make sure policies are easy to find. Again, you want customers to come to you instead of the bank. Make it easy for them to do that. Prominently display a link to your policies on your homepage, product pages, checkout page, and order confirmation emails.

Consider free return shipping. If your goal is to keep chargeback counts as low as possible and your margins will allow for it, you might want to consider free return shipping — because a chargeback doesn’t cost the cardholder anything.

Extend return timelines. In most cases, cardholders can wait 90 to 120 days to file a chargeback. If your return time limit has passed but the chargeback time limit hasn’t, a chargeback is the only option a customer has.

Use Tools to Prevent Fraud

Criminal fraud is one of the main causes of chargebacks. If a fraudster makes an unauthorised purchase, a chargeback is justified.

Fortunately, there are tools available to help detect and block unauthorised transactions so you can avoid the resulting chargebacks.

NOTE

There are several available tools to help prevent criminal fraud. But these tools don’t compete with one another; they complement each other. Each has different capabilities and protections.

You don’t have to pick and choose the “best” tools — it’s possible to use them all. In fact, we recommend a multi-layer strategy. The more tools you use, the better your protection will be.

If you’d like to learn more about creating a complete strategy for fraud and chargeback, check our chargeback prevention page.

3D Secure 2.0

3D Secure 2.0 verifies a shopper’s identity by comparing transaction, order, and user data provided during checkout with information the issuing bank has on file.

When a shopper initiates a transaction on your website, information is sent to the cardholder’s bank in real time. Some example data points include:

- Transaction amount

- Account number

- Card expiration date

- Email address

- Shipping address

- IP address

- Device information

The issuer uses machine learning to analyse the provided information and determine the likelihood of fraud. Based on the analysis, the issuer will suggest you do one of the following:

- Approve the transaction because the bank believes the shopper is the actual cardholder.

- Challenge the transaction because the information provided doesn’t match what’s on file or otherwise seems suspicious. Transactions can be challenged with a one-time password sent via email or text.

3D Secure 2.0 is provided by various third-party vendors and fulfills Europe’s PSD2 requirements. Check our payment technology page if you’d like a recommendation.

NOTE

3D Secure technology was initially launched several years ago. The first iteration caused a lot of friction and cart abandonment. The technology was updated to be more user-friendly and accurate. If you had reservations about using 3D Secure, you might want to reevaluate the entirely new 3D Secure 2.0.

Card Security Codes

Requesting the card security code during checkout can help prove the shopper has possession of the physical card — and isn’t using information stolen from a data breach.

A card security code is the three- or four-digit number printed on debit and credit cards. This code goes by brand-specific names:

- American Express – Card Identification Number (CID)

- Mastercard – Card Verification Code (CVC)

- Visa – Card Verification Value (CVV)

Once a transaction is initiated, the card security code is transmitted to the issuer in real time. The issuer checks what number is actually printed on the card and sends back a response. Based on the response provided, you’ll likely do one of two things:

- Approve the transaction because the code provided matches what is actually printed on the card.

- Decline the transaction because the code provided doesn’t match — and a fraudster is likely attempting an unauthorised transaction.

If you want to incorporate card security codes into your fraud detection strategy, contact your payment processor. Your processor controls whether or not this technology is incorporated into the transaction processing workflow.

Address Verification Service (AVS)

Address Verification Service compares the billing address provided during checkout to the billing address on file with the cardholder’s issuing bank. The idea is that the cardholder would know this personal information, but a fraudster probably wouldn’t.

When you send the billing address to the issuer for authentication, you’ll receive one of a dozen different responses. For example, both the street address and ZIP code match. Or only the ZIP code matches. Or maybe nothing matches, and it’s likely fraud.

Based on the response provided, you’ll have to decide if you want to approve or decline the transaction.

If you’d like to start using AVS, reach out to your payment processor. Your processor can enable this technology for you.

Third-Party Solution Providers

There are various vendors on the market today that use additional tactics and solutions to detect fraud.

Typically, these technologies look for common indicators of suspicious activity. For example:

- Using different cards to make multiple purchases from the same IP address

- Buying multiples of a single item that is easy to resell

- Shopping from a location that doesn’t match the cardholder’s billing address

Like 3D Secure 2.0, card security codes, and AVS, these technologies flag potentially fraudulent behaviour. But as an added bonus, most third-party solution providers can go one step further to actually decline suspicious transactions on your behalf.

There are dozens of available solution providers. Check our payment technology page if you’d like a recommendation.

Use Tools to Resolve Disputes

Some purchases go exactly as planned. But other times, either the cardholder or the issuing bank has a problem with the transaction.

When a transaction needs to be disputed, the issuer will launch the dispute process. If you use a dispute resolution tool, the process will be paused so you can respond. If you don’t respond or you don’t use a resolution tool, the dispute will advance to a chargeback.

The following is a high-level overview of dispute resolution tools.

NOTE

There are several different tools that can resolve disputes and eliminate the need for chargebacks. But it’s important to note that these tools don’t compete with one another; they complement each other. Each has different use cases and protections.

You don’t have to worry about picking the “best” tool — you can use them all. In fact, we recommend a multi-layer strategy. The more tools you use, the better your protection will be.

Visit our chargeback prevention page if you’d like to learn more about our complete strategy.

Order Insight

Order Insight shares information with issuing banks in real time.

When a cardholder contacts the bank to dispute a purchase, the issuer can send an Order Insight inquiry. Within two seconds, a response is returned with information such as:

- The business’s name and contact information

- A description of what was purchased

- The shopper’s contact information

The hope is that additional insights will help clarify the purchase and eliminate the need for a chargeback.

Order Insight is a Visa product, managed by certified resellers like AltoPay.

Prevention Alerts

Prevention alerts give you advanced notice of a dispute — usually between 24 and 72 hours — so you can review the situation and determine a response.

For example, if you’ve issued a refund, you can let the bank know that a credit is already on the way. Or maybe, when alerted, you decide to refund the transaction and resolve the case.

Usually, once a transaction is refunded, a chargeback is no longer needed.

Prevention alerts are provided by two vendors: Ethoca and Verifi.

You can integrate directly with each vendor, or you can consolidate solutions via a single provider — like AltoPay. Using a solution provider is usually the best option — for a variety of reasons (check this article about why you’d use AltoPay for alerts). Management is simpler, you’ll get better results, and you can easily monitor outcomes. Plus, the alert pricing is the same no matter who you work with.

Check our prevention alerts page to learn more.

Rapid Dispute Resolution

Rapid Dispute Resolution resolves disputes by issuing refunds.

When you set up this solution, you’ll be prompted to create filters or rules that outline when you are and aren’t willing to accept liability. For example, maybe you only want to accept disputes with a certain reason code or over a set transaction amount.

Then, the bank will automatically refund disputed transactions that fit your criteria.

Rapid Dispute Resolution is a Visa solution, provided to merchants via certified resellers like AltoPay. Check our chargeback prevention page to learn more.

Understand the Impact of Chargebacks

Usually, revenue loss is the biggest, most noticeable impact of chargebacks.

No business wants to lose money. But we often hear merchants just accept chargebacks as a cost of doing business because they don’t have the resources needed to manage disputes effectively.

But managing chargebacks is about much more than avoiding short-term financial losses. If you don’t have a chargeback prevention strategy in place, you could lose your ability to process payments.

Because other industry members — like your acquirer and the card brands — don’t like losing money either. And they certainly don’t want to forfeit revenue because of your inability to manage fraud and chargebacks.

So to protect themselves from potential risk caused by their merchants, the card brands have created chargeback monitoring programs. These programs are intended to be both a penalty for excessive chargebacks and a corrective effort to help manage chargebacks more effectively.

If you struggle to effectively prevent chargebacks, you could be enrolled in a monitoring program — and suffer the consequences.

Here are four things you need to know about monitoring programs.

CONSEQUENCE #1

You’re expected to carefully monitor your risk metrics.

Industry members use a couple different metrics to monitor risk. Metrics — and how they are calculated — can vary by card brand and processor. But here are the general measurements used most commonly.

- Chargeback count: This metric counts how many chargebacks you receive each month. It’s usually calculated per merchant account and broken down by card brand.

- Chargeback-to-transaction ratio: This metric calculates the percent of monthly transactions that have a corresponding chargeback. Again, the ratio is calculated for each merchant account and broken down by brand.

NOTE

Visa is changing how chargeback risk is monitored. Check our article explaining VAMP to learn more.

It’s your responsibility to continuously calculate and monitor these metrics. And that’s no easy task. It requires accessing data that could be stored in multiple platforms, consolidating it in one place, and regularly running the calculations.

Even though this can be a challenging task, it’s an essential one.

A proactive strategy is easier to manage than a reactive strategy. Knowing where you stand means you can quickly adjust your strategy as risk fluctuates. But if you ignore your data and hope for the best, you could find yourself at a point where it’s impossible to recover.

CONSEQUENCE #2

You’ll pay more fines.

Chargebacks are usually accompanied by a chargeback fee. This fee is charged by the acquirer and used to cover administrative costs.

If you are enrolled in a chargeback monitoring program, you’ll probably have to pay additional fees — either per dispute or a set amount each month.

So basically, these fees mean you are paying money to lose revenue. And the longer you are in a program, the more you’ll forfeit.

CONSEQUENCE #3

If you’re in a monitoring program, you’ll want to get out.

The card brands set thresholds for risk monitoring metrics, and you are expected to stay below the limits.

The threshold for the chargeback-to-transaction ratio varies but is usually between 0.9% and 1.5%.

If you go over that limit, you could be enrolled in a program. To get out of the program, your chargeback activity has to go below the limit and stay there for several months.

That’s where a comprehensive chargeback prevention strategy comes into play. If you’ve been enrolled in a monitoring program, you’ll need a quick and drastic reduction in chargebacks. And implementing the tools and suggestions we’ve shared here, in this guide, can help.

Check our chargeback prevention page to learn how to get started.

CONSEQUENCE #4

If you can’t get out of the program, your merchant account could be closed.

The card brands offer their chargeback monitoring programs as a warning for excessive chargebacks. These programs give you the chance to make necessary adjustments to help lower your risk.

But the card brands only give you so much time. If you aren’t able to achieve the desired results quick enough, your acquirer will probably close your account.

If you lose a merchant account, you’ll probably struggle to continue processing payments. And if you can’t process payments, you’ll have a hard time earning enough revenue to stay in business.

NOTE

This information isn’t intended to intimate or scare you. Chargebacks can affect any online business. And even well-established businesses can struggle to keep chargebacks under control.

While we don’t want to be all doom and gloom, we do want you to recognize the importance of chargeback prevention. The sooner you put a strategy in place, the easier it will be to manage risks.

Check our chargeback prevention page to learn more about available solutions and a comprehensive strategy.

Measure Your Chargeback Prevention Results

Chargeback management is a dynamic process. Even the most effective techniques have to adapt as threats evolve.

To get the best results possible, you’ll want to monitor outcomes and make adjustments when necessary.

Here are some key performance indicators (KPIs) to keep an eye on.

Chargeback Ratio

The chargeback-to-transaction ratio is a metric that’s widely used throughout the payments industry.

It calculates the percent of monthly transactions that have a corresponding chargeback.

Here’s how American Express, Discover, and Visa calculate the ratio:

Number of Chargebacks in Current Month ÷ Number of Transactions in Current Month x 100 = Chargeback Ratio

Here’s how Mastercard calculates the ratio:

Number of Chargebacks in Current Month ÷ Number of Transactions in Previous Month x 100 = Chargeback Ratio

Depending on the card brand, your ratio usually has to be below 0.9% – 1.5%.

You definitely want to keep your ratio within the limits, but that’s not the only way to think about this KPI.

Let’s consider a hypothetical example.

Acme Corporation doesn’t have to worry about breaching ratio thresholds. Chargeback risk is minimal, and their average ratio hovers around 0.4%. One month, out of the blue, Acme’s ratio spikes to 0.8%.

Should the business not worry because the ratio is still below thresholds?

No! Any increase or out-of-the-norm activity is noteworthy.

Ok, let’s consider another example.

Dunder Mifflin has a 1.3% chargeback ratio and will soon be enrolled in a monitoring program. They need to get their ratio below the threshold — quick. So they do some deceptive things to artificially lower their ratio.

Should the business celebrate their achievement?

No! Attempts to conceal problems, disguise risk, or unnaturally improve performance metrics are in direct violation of numerous regulations.

Of course card brand thresholds are important. But focusing on them exclusively probably won’t get you the long-lasting results you’re looking for. Instead, create a strategy that revolves around stability and consistency. And focus on finding a balance between risk and revenue that’s perfect for your business.

Check our chargeback prevention page to learn more about creating a balanced chargeback management strategy.

Percent Prevented

Chargeback prevention tools provide a lot of useful data. And that data can help you measure the success of your strategy.

Start by checking how many chargebacks are prevented by each tool. Here’s an example.

Number of Alerts ÷ (Number of Alerts + Number of Chargebacks) x 100 = Percent Prevented

Each business and each strategy is different. However, here are some average benchmarks to compare your results.

- Order Insight resolves about 10-20% of Visa disputes.

- Alerts resolve about 30-40% of disputes.

- RDR resolves about 90% of Visa disputes.

After you determine results for each tool, calculate the effectiveness of all your tools combined — alerts, Rapid Dispute Resolution, and Order Insight. Like this.

(Alerts + RDR + OI) ÷ (Alerts + RDR + OI + Chargebacks) x 100 = Percent Prevented

Monitor results over time. If outcomes aren’t what you anticipated, consider changing your management strategy.

For example, could you integrate your CRM with Order Insight and send dynamic responses instead of static? Could you move from manual alert management to automated so cases don’t expire? Do you need to adjust your RDR filters so you can resolve more disputes?

If you use AltoPay for chargeback prevention solutions, we can help you monitor and optimise your strategy. Check our chargeback prevention page to learn more about the support we provide.

Overlap and Leakage

Most of the time, your chargeback prevention strategy will work exactly as you intended. But other times, things won’t go as planned.

There are two metrics that can help monitor glitches in your strategy.

- Overlap is a single dispute case with multiple resolution attempts. For example, a disputed transaction receives both an Ethoca alert and a Verifi alert.

- Leakage is a prevention attempt that doesn’t stop the chargeback.

Overlap and leakage are most common with prevention alerts.

Some issuers are a part of both Ethoca and Verifi networks, so overlap can happen. However, it’s pretty rare, affecting between 4% and 10% of cases.

Leakage can happen for a couple reasons:

- A refund wasn’t issued quick enough.

- A response wasn’t sent or wasn’t sent within the time limit.

- Only a partial refund was issued, and the cardholder disputed the remaining amount.

- The issuer made a mistake (new employee, processing error, technical difficulties, etc.)

Like overlap, leakage is rare, affecting about 7-10% of cases.

NOTE

Even though prevention tools do have a chance for error, we still recommend creating a multi-solution strategy. The benefits far outweigh any potential drawbacks.

For example, if you drop a solution because it is causing 5% overlap, you’ll miss out on the 95% coverage that solution is capable of providing.

In certain situations, you may be reimbursed for unsuccessful resolution attempts.

But to receive financial credits, you need a system to detect, prove, and report overlaps and leakage. Using a robust data platform that consolidates all your prevention cases is the most efficient and transparent way to monitor performance.

AltoPay provides detailed reporting for all chargeback prevention solutions — making it easy to track and improve results. Visit our chargeback prevention page to learn more.

Build a Complete Strategy for Chargeback Management

Because it’s impossible to completely emanate the risk of chargebacks, your management strategy should look something like this:

Prevent the preventable. Fight what can’t be prevented.

You can and should respond to invalid chargebacks so you can recover revenue that’s been sacrificed.

We offer a complete guide to revenue recovery. Check it out!

Start Preventing Chargebacks with AltoPay

Are you ready to build the best chargeback prevention strategy possible? Head over to our chargeback prevention page to learn how to get started.

For more than a decade, Jessica Velasco has been a thought leader in the payments industry. She aims to provide readers with valuable, easy-to-understand resources.