What is interchange? Interchange is just one of the many fees you have to pay as part of your payment processing strategy.

Understanding interchange fees is important. If you don’t know how much it costs to run your business, you can’t accurately determine ROI.

In this guide, we’ll share everything you need to know about interchange.

What are interchange fees?

An interchange fee is a payment processing fee that is paid to the cardholder’s issuing bank. Fees are intended to cover the costs and risks associated with processing a transaction.

If you, a merchant, want to accept credit and debit cards as a form of payment, you have to pay for the privilege. And there are various entities you have to pay for helping you out — the cardholder’s issuing bank, the card scheme, and your acquirer.

Here’s how those three entities get paid:

The interchange fee is paid to the cardholder’s issuing bank.

The card scheme fee is paid to the corresponding card brand (Visa, Mastercard, etc.)

The acquirer or processor fee is paid to the entity that supplies your merchant account.

The interchange fee is paid to the cardholder’s issuing bank.

The card scheme fee is paid to the corresponding card brand (Visa, Mastercard, etc.)

The acquirer or processor fee is paid to the entity that supplies your merchant account.

Let’s look at an example of how these three fees fit into a single purchasing experience.

Let’s say a cardholder makes a purchase with a Visa credit card issued by Capital One. You process the payment with your merchant account maintained by Fiserv.

In this situation, the interchange fee would be paid to Capital One, the scheme fee would be paid to Visa, and the acquirer fee would be paid to Fiserv.

RELATED READING

Debit & Credit Card Processing Fees: Everything You Need to Know

Why do you have to pay an interchange fee?

The fee is intended to compensate the issuing bank for their involvement in your business’s sale.

- Promoting card usage and encouraging consumers to apply for accounts

- Administer credit checks and offering accounts to qualified consumers

- Providing customer support to cardholders

- Conducting authorization checks and approving or declining transactions

- Detecting and responding to fraudulent card use

- Maintaining the card brand’s transaction processing infrastructure

Who pays interchange fees?

Any merchant that accepts credit, debit, and prepaid cards as a form of payment is charged an interchange fee for each transaction that is processed.

This applies to both in-person purchases made at brick-and-mortar locations and card-not-present transactions made online, over the phone, or through the mail.

Interchange fees apply to all regions and most card brands (American Express and Discover handle the fee structure slightly differently than brands like Mastercard and Visa).

NOTE

Payment processing fees can be a complex topic. We encourage you to check out our complete guide that explains what fees are collected and how they are paid.

Your acquirer will probably use one of the four most popular pricing models to collect fees. Our guide explains each in detail:

- Interchange++ pricing

- Interchange+ pricing

- Tiered pricing

- Flat-rate or blended pricing

Depending on which model your acquirer or processor uses, you might not know how much you are paying in interchange fees. But even if you have a less-transparent pricing model that doesn’t reveal this information, you are still paying this fee.

How do interchange fees work?

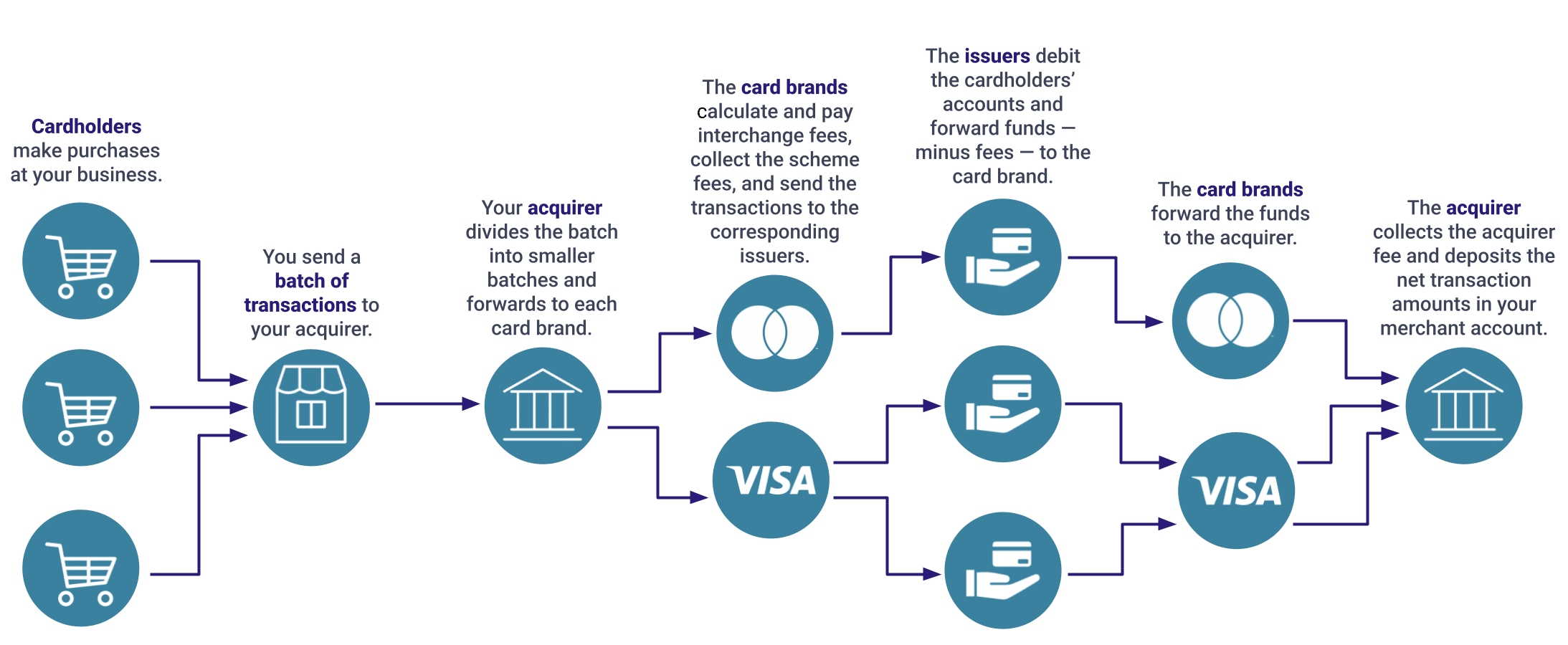

How does interchange work? Here’s how fees are charged and collected.

- You process a transaction. And then another. And then another. You collect all the transactions processed in a given time period — usually a day — into a batch.

- You send the batch of transactions to your acquirer for settlement. Settlement means sending each individual transaction to its corresponding issuing bank for payment via the corresponding card network (Mastercard, Visa, etc.).

- Courtesy of the card networks’ integrated technology, transaction characteristics — like the type of card, location of your business, etc. — are analyzed and an appropriate interchange rate is selected for each transaction. Interchange fees are paid to the issuers and the scheme fees are collected by the card networks.

- Issuing banks receive the transactions and debit their cardholders’ accounts for the full transaction amounts.

- The transaction amounts — minus interchange and scheme fees — are forwarded to your acquirer.

- Your acquirer collects a fee and deposits the net transaction amounts into your merchant account.

The process looks like this:

How much are interchange fees?

Unfortunately, there is no set interchange rate that is applicable to all merchants in all situations. Rates fluctuate from one transaction to the next and can be influenced by several things.

Let’s take a deep dive into the nuances of interchange fees.

Transactional factors affecting interchange

There are several factors that can impact interchange rates. Here are some that are most impactful.

- Transaction method – How you process a transaction impacts interchange rates. Card-present transactions typically have lower interchange rates than card-not-present transactions.

- Card type – Different types of cards have different interchange rates. Rewards cards, premium cards, and commercial cards usually have the highest interchange rates. Consumer credit cards typically have mid-level interchange rates. And consumer debit cards often have the lowest interchange rates.

- Merchant category code – All businesses are classified with an MCC. MCC assignments are a reflection of the business’s main source of revenue — the goods and services that are sold and how they are sold. Some MCCs are classified as high risk and have a higher-than-normal interchange rate.

- Region – If both the acquirer and issuer are in the same country, the interchange rate will be low. If the two financial institutions are in different countries, the interchange rate will be higher.

- Processing strategy – How you handle a transaction could impact its interchange rate. For example, the interchange rate will be lowest if you settle the transaction within 24 hours. Transactions using encryption or tokenization will also have the lowest rate possible. If you process transactions on corporate or government cards, transactions with Level 3 data will have lower rates than transactions with just Level 1 data. Manually entering card information can cause interchange rates to increase.

How to calculate interchange fees

Fortunately, you aren’t responsible for determining which interchange rate applies to each transaction. The card network’s technology will handle that.

But it is helpful to have a rough idea of what you pay each month in interchange fees.

If your acquirer or processor uses interchange++ or interchange+ pricing, you’ll have all the information you need to calculate how much you spend each month in interchange fees.

Your monthly processing statement will probably list out each transaction and the interchange rate for each — you can simply add all these fees together. Depending on your acquirer or processor, there might be a line item on your statement that totals all the interchange fees for you.

If your acquirer or processor uses a different pricing method, you might not know the exact interchange rate for each transaction. So here’s what you can do to calculate interchange fee estimates.

- Think about your customer makeup. You probably know if your customers are predominantly using consumer cards or corporate cards.

- Figure out the ratio of debit to credit card transactions. Globally, about 51.27% of purchase volume is made with a credit card versus just 48.73% with a debit card. However, card usage can vary significantly by region. Check your customer’s makeup and card usage preferences.

- Determine geographies and brands. Count how many transactions are processed by each brand and in each country.

- Consult interchange rate tables for Visa and Mastercard. Use the insights you’ve gathered to reference the country-specific interchange charts provided by each card brand.

Interchange fee example

Some interchange rates are a percentage of the transaction amount — like 0.3%.

Other interchange rates are both a percentage of the transaction amount and a flat fee — like 1.2% + $0.10.

Some rates have a minimum or maximum fee amount — like 0.80% + $0.15 with a $0.95 cap or 1.30% with a minimum of €0.35.

Where can I find a list of interchange rates?

The card brands (Visa, Mastercard, etc.) set the interchange rates and updated them twice a year (in April and October).

We’ll share links to the main interchange page for each region. On that page, you’ll find links to the most recent interchange fees charts.

Visa interchange rates

What is the interchange rate for Visa? You’ll have to check the interchange tables for each country you process in and cross-reference card type.

Please reach out to our team if you are interested in LATAM (Latin America) interchange rates for Visa.

Mastercard interchange rates

What is the interchange rate for Mastercard? We’ll share the Mastercard interchange tables for each country.

Please reach out to our team if you are interested in Mastercard pricing for LAC (Latin America and the Caribbean) interchange rates.

Discover interchange rates

You can find a link to Discover interchange rates on the card brand’s website, but you’ll need a verification code provided by your acquirer to access the interchange rate tables.

American Express interchange rates

American Express interchange fees are very different from Visa and Mastercard interchange rates. In fact, the card brand doesn’t even use the term interchange! Instead, American Express has a wholesale discount rate and network assessment fees.

Rather than assign rates based on card type, American Express considers the industry and transaction amount.

Interchange Fee Regulation

In some regions, government organizations have imposed limits to interchange rates. The two most notable apply to Europe and the United States.

By setting a maximum amount for interchange, officials aim to lower costs for business which will, in turn, lower costs for consumers.

United State’s Durbin Amendment and the The Federal Reserve’s Regulation II

Part of the 2010 financial reform legislation, the Durbin amendment — implemented by The Federal Reserve’s Regulation II — includes an interchange fee cap for banks with $10 billion or more in assets. For these banks, the interchange rate for debit card transactions is capped at 0.05% + $0.21 (but banks can add an additional $0.01 for certain fraud-prevention measures).

In 2025, the legislation was scrutinized by courts and may be overturned.

European Interchange Fees Regulation

In Europe — effective December 2015 — the interchange fees for consumer debit cards are capped at 0.2% and consumer credit cards are capped at 0.3%.

How to reduce interchange fees

Interchange fees are fixed and non-negotiable. However, there are some things you can do to help reduce costs.

- Work with the right solution provider. Before you can reduce your fees, you have to first figure out what you are currently paying. And if your processor or acquirer’s pricing model isn’t transparent, you won’t have access to this crucial data. If possible, opt for an interchange++ or interchange+ pricing model. AltoPay uses these pricing models and would be happy to provide a more transparent fee structure.

- Optimise your payment processing strategy. Implementing best practices can help lower your interchange rate. For example, settling transactions within 24 hours, using encryption or tokenization, and providing Level 3 transaction data can help ensure the lowest interchange rate possible.

- Apply for more merchant accounts. The highest interchange rates are usually for cross-border transactions. You can lower your fees by obtaining a merchant account in the regions where you do the most sales. For example, if you are currently based in the United States and have seen an influx in purchases from European customers, then maybe you need a European merchant account. AltoPay provides merchant accounts in multiple regions — check to see if we’d be a good fit for your business.

Quick FAQs about debit and credit card interchange fees

Here are some of the most commonly asked questions we receive about interchange fees.

Q: Are interchange fees for credit cards different from debit cards?

Yes. Interchange credit card rates tend to be much higher than interchange debit card rates.

The only exception is for intra-European transactions (transactions where both the issuer and acquirer are located within the European Economic Area). There is a minor difference between card types — debit cards are 0.2% and credit cards are 0.3%.

Q: What is the difference between interchange and assessment fees?

The interchange fee is paid to the issuing bank. The assessment fee — sometimes called a card scheme fee — is paid to the card brand (Mastercard, Visa, etc.). Check our guide to learn more about payment processing fees.

Q: What are the average interchange fees?

Interchange rates can fluctuate significantly from transaction to transaction. In most situations, the average is between 0.05% and 2.60%.

In Europe, rates are capped at 0.3% for all consumer cards.

Q: What’s the difference between a merchant discount rate vs interchange fee?

The merchant discount rate is the total amount you pay in fees for a given transaction. The MDR includes the interchange fee — along with the scheme fee and the acquirer fee.

For more than a decade, Jessica Velasco has been a thought leader in the payments industry. She aims to provide readers with valuable, easy-to-understand resources.