If you accept debit and credit cards as a form of payment, you’ll need to pay processing fees. And if you are charged a fee, you probably want to know how much the fee is, who you are paying the fee to, and how to make sure the fees you pay are comparable to other businesses like yours.

Use our detailed guide to understand the essentials.

TL;DR

Quick answers about card processing fees

Here are some quick answers to the most common questions about processing fees. But be sure to check out our entire guide if you are interested in lowering costs and optimising ROI.

What are payment processing fees?

Payment processing fees are the fees you pay to cover the costs associated with processing debit and credit card transactions.

Processing fees — sometimes called merchant account fees or merchant processing fees — can be broken down into three different charges, each sending funds to a different entity in the payments ecosystem.

The interchange fee is paid to the cardholder’s issuing bank.

The card scheme fee is paid to the corresponding card brand (Visa, Mastercard, etc.)

The acquirer or processor fee is paid to the entity that supplies your merchant account.

The interchange fee is paid to the cardholder’s issuing bank.

The card scheme fee is paid to the corresponding card brand (Visa, Mastercard, etc.)

The acquirer or processor fee is paid to the entity that supplies your merchant account.

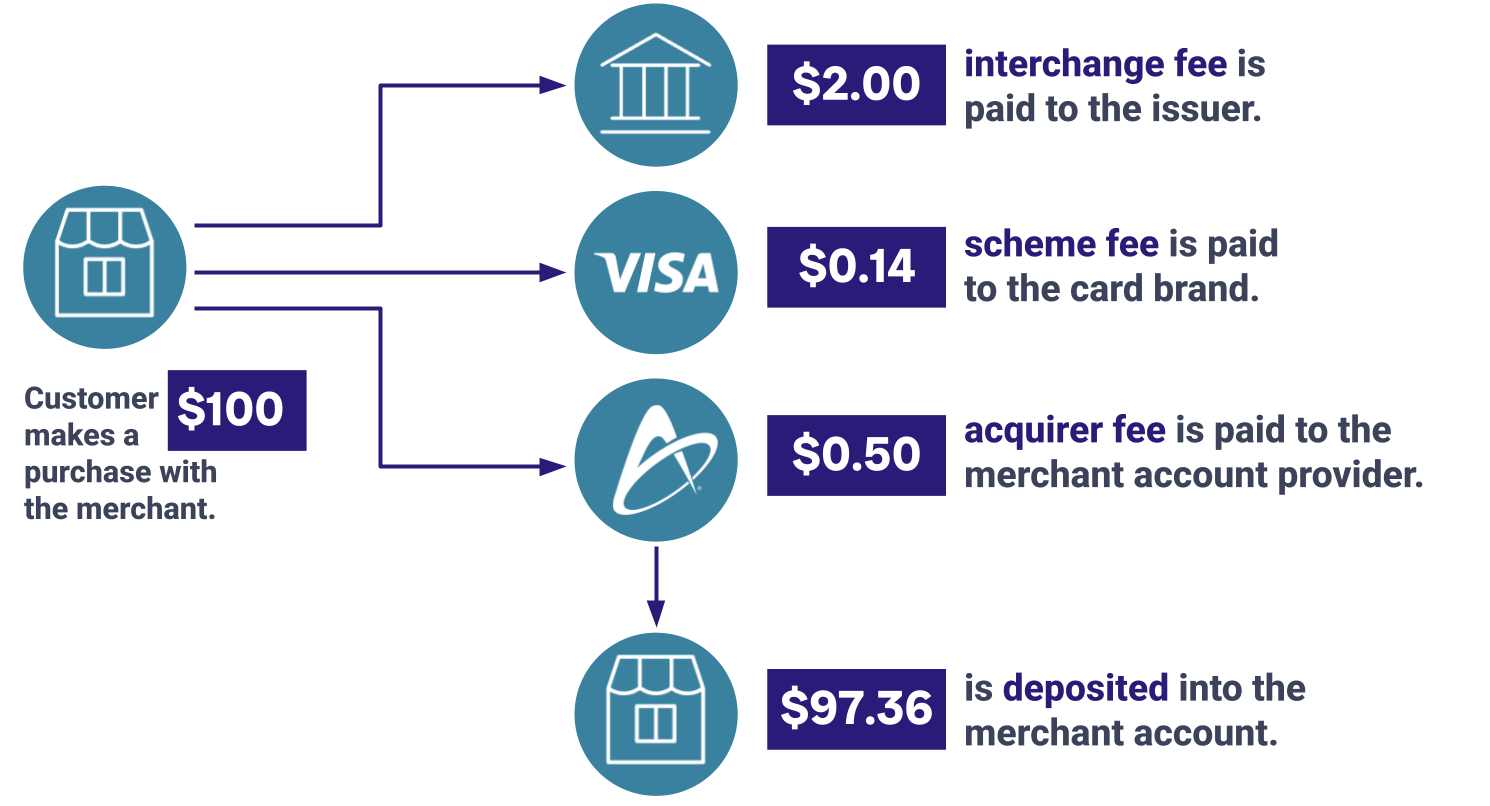

Let’s use some random numbers to create a hypothetical fee structure for a transaction processed with a Visa card issued by Wells Fargo and a merchant account issued by AltoPay as an acquirer.

- Example transaction amount: $100

- Example interchange rate: 2%

- Example scheme rate: 0.14%

- Example acquirer rate: 0.5%

In this scenario, you would pay $2 in interchange fees to Wells Fargo, $0.14 in scheme fees to Visa, and $0.50 in acquirer fees to AltoPay. Once all fees are paid, $97.36 would be deposited into your bank account.

Our hypothetical scenario looks like this:

Average payment processing fees

Processing fees vary from business to business. And they can even vary from one transaction to another. Generally, the lower the risk, the less that is paid.

On average, an online business accepting debit, credit, and prepaid cards from the most popular card brands (Visa, Mastercard, etc.) for cross-border purchases can expect to pay roughly 2-6% of revenue in processing fees.

If you are just starting out with online sales or are interested in switching payment platforms, it is best to ask your prospective solution provider for a custom quote. Taking your business’s unique characteristics into consideration will give you the most accurate estimate for debit and credit card processing fee percentages.

Now, let’s look at each fee individually.

Interchange fees explained

The interchange fee is paid to the issuing bank that provided the payment card to the consumer. For example, if the cardholder’s purchase was made with a Visa credit card issued by Capital One, the interchange fee would be paid to Capital One.

The fee is intended to cover things such as:

- Promoting card usage and encouraging consumers to sign up

- Conducting background checks and extending credit to qualified consumers

- Providing customer support to cardholders

- Conducting authorization checks and approving or declining transactions

- Detecting and responding to fraudulent use of cards

- Maintaining the card brand’s transaction processing infrastructure

Average interchange fees

Interchange rates vary significantly from one transaction to another. Check our detailed guide to learn more about interchange fees and why they fluctuate.

RELATED READING

Interchange rates are typically a percent of the transaction amount, and averages range between 0.05% and 2.60%. In Europe and the UK, interchange fees are capped to a maximum of 0.3% for domestic transactions for all cards except corporate cards.

Sometimes, rates are a combination of a percent of the transaction amount and a flat rate fee. For example, 1.19% + $0.10. Some rates have minimum and/or maximum fee amounts. For example, 0.80% + $0.15 with a $0.95 cap or 1.30% with a minimum of €0.35.

Interchange rates are set by the card brands (Mastercard, Visa, etc.) and are usually updated twice a year (in April and October).

Debit card vs. credit card processing fees

Debit card transactions usually have lower processing fees than credit card transactions. The reason is because credit cards have higher interchange rates. Issuers take more risks with credit cards and often have to pay cardholder rewards or points. Interchange compensates for these additional costs.

- Average debit card processing fees: 0.5% – 1.5%

- Average credit card processing fees: 1.5% – 3.5%

Since debit cards have lower processing fees, you would ideally process more debit card transactions than credit card transactions. Unfortunately, there isn’t an effective way to entice cardholders to use one type of card instead of another. But there is a bit of good news.

In some regions — like Europe — debit cards are more popular than credit cards. So if you have a global sales strategy, you might automatically have more debit transactions than credit.

Card scheme fees explained

The card scheme fee — sometimes called dues and assessment, a card brand fee, or a card network fee — is paid to the brand associated with the card used to make the purchase.

For example, if the cardholder’s purchase was made with a Visa credit card, the scheme fee would be paid to Visa.

Scheme fees are like dues for a club membership — you, the merchant, are paying for the privilege of processing transactions through the card brand’s network.

Average scheme fees

There are a lot of similarities between interchange and scheme fees.

- Both interchange and scheme fees take a percent of the transaction amount.

- Both interchange and scheme fees are set by the card brands and usually updated twice a year (in April and October).

- Both interchange and scheme fees are collected as each individual transaction is settled.

- Both interchange and scheme calculations can be complex and influenced by dozens of different factors.

Scheme fees vary by card network, but the difference is minimal. Currently, you can expect to pay roughly 0.13% to 1.07% of your monthly revenue in scheme fees. Rates are typically either a percentage of revenue or a percentage plus a flat fee — for example, 1.07% + € 0.13.

Acquirer or processor fees explained

The third fee you are required to pay goes to the financial institution or acquirer that supplies your merchant account.

For example, if Fiserv provides your merchant account, you’ll pay this fee to Fiserv.

The merchant bank fees are intended to cover things such as:

- Reviewing and implementing card brand regulations

- Maintaining the card brand’s infrastructure

- Facilitating your payments and managing fee distribution

- Accepting financial liability if your risk becomes unmanageable

Average acquirer fees

There are several different pricing models an acquirer, processor, or solution provider might use. We’ll go over the four most popular options in the next section. They are:

- Interchange++ pricing (primarily Europe and UK)

- Interchange+ pricing

- Tiered pricing

- Flat-rate or blended pricing

Acquirers, processors, and solution providers might charge a percentage of the transaction amount, a fixed amount, or a combination of both.

Average prices can vary drastically based on a given business’s unique features — with the most impactful characteristic usually being fraud and chargeback rates. The higher the risk, the higher the fee.

Pricing models for payment processing fees

Acquirers typically use one of four pricing models to manage debit and credit card processing fees.

Let’s look at each individually.

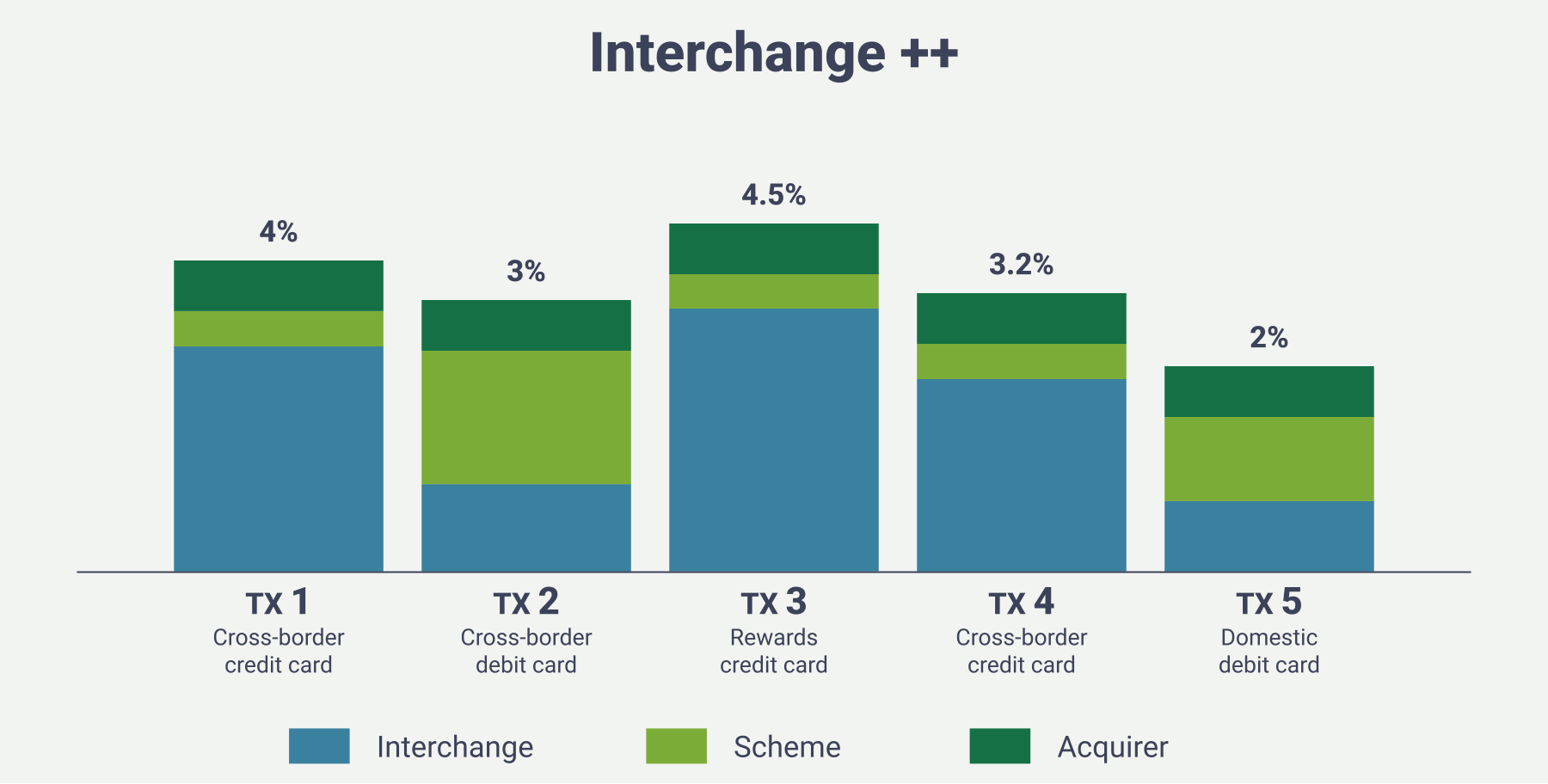

Interchange++ pricing

The interchange++ (or interchange plus plus or IC++) pricing model is basically what the name implies. You would be billed an interchange fee plus a scheme fee plus an acquirer fee for each transaction you process.

Note

Interchange++ is a pricing model that’s primarily used in Europe and the UK due to government mandates on transparency. Interchange+, which we’ll explain in the next section, is used outside Europe — especially in the United States.

Here are the pros and cons of the interchange++ pricing model:

- PROS: This is the most transparent pricing model. You will know exactly what you are paying for each transaction. The total amount you pay for each transaction will fluctuate, but you’ll always pay the same amount to your acquirer or processor.

- CONS: This pricing model can be difficult to reconcile and project profits because the same product can have different processing fees depending on card type, country of the customer, etc.

Here’s a visual to demonstrate how fees are distributed to the different entities in the ecosystem and how costs can fluctuate from transaction to transaction.

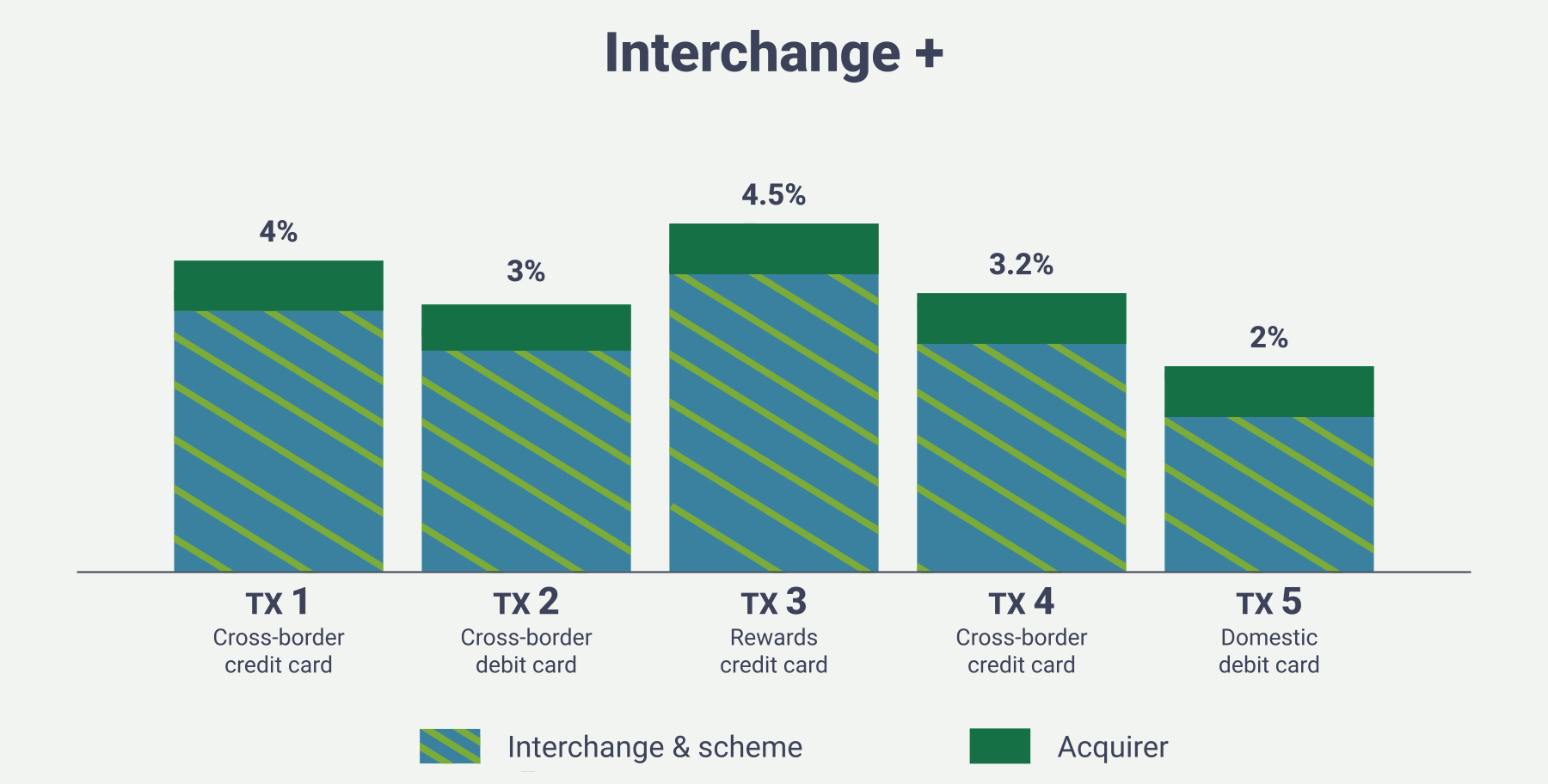

Interchange+ pricing

The interchange+ (or interchange plus or IC+) pricing model is similar to interchange++, but it combines the interchange fee and scheme fee into a single cost. So it is the combined interchange and scheme fees plus the acquirer fee.

Note

The interchange+ pricing model can be implemented by any acquirer or processor worldwide — except those in Europe. In Europe, acquirers and processors have to break down the interchange fee and scheme fee into two separate charges — thus the interchange ++ system.

Here are the pros and cons of the interchange+ pricing model.

- PROS: This pricing model blends simplicity with transparency. Rather than have three components in your fee structure, you only have two — yet you can still clearly see how much you are paying and to who. One component is usually fixed (the acquirer fee) and one is dynamic (interchange and scheme fees vary from one transaction to the next). Because of the transparency, you should pay less than a tiered or blended model.

- CONS: Your monthly processing statements can be very long, detailed, and complex — but they are complete and transparent.

Here’s a visual to demonstrate the static vs. dynamic fees and how costs can fluctuate for each transaction.

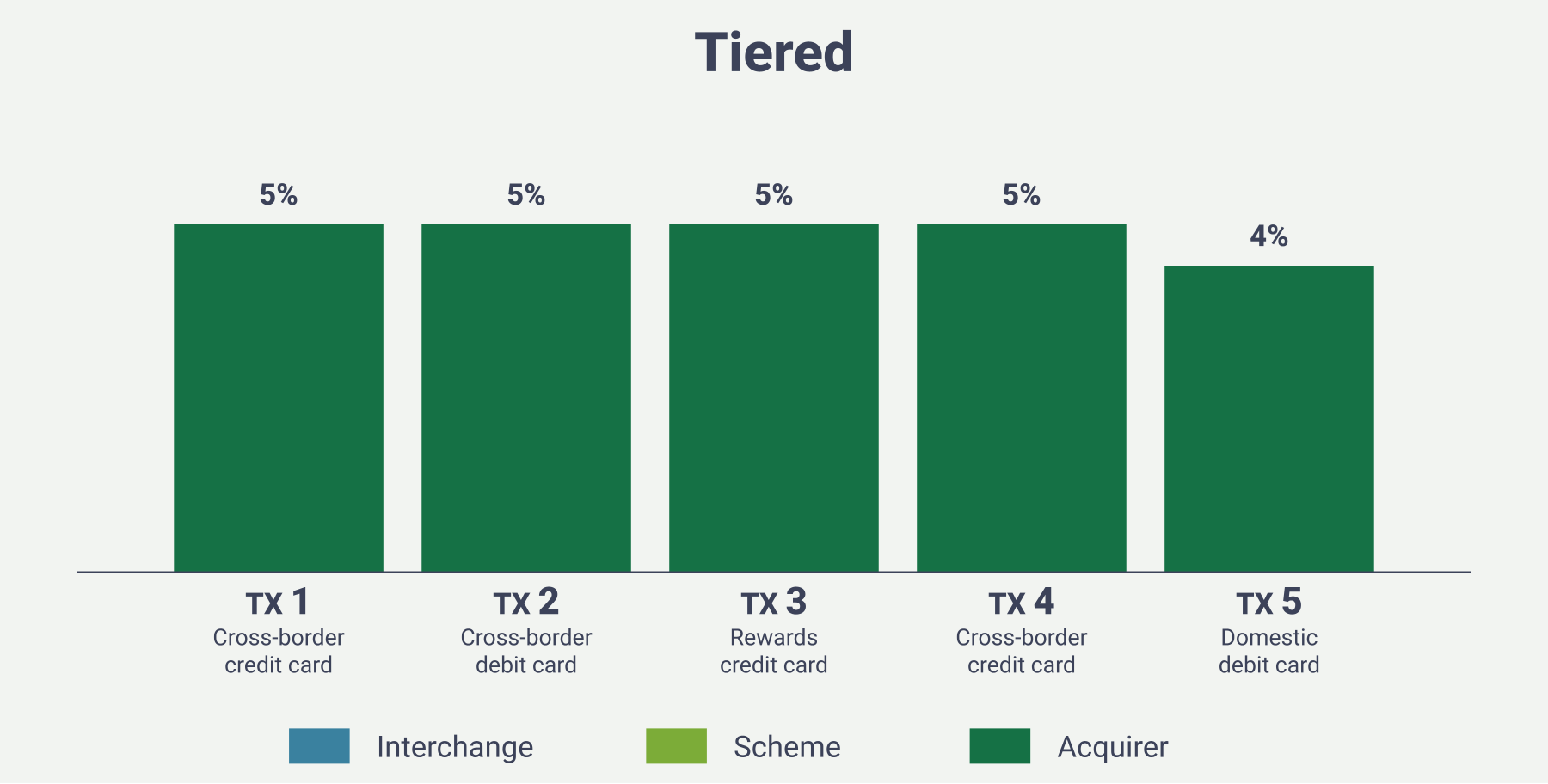

Tiered pricing

The tiered pricing model groups transactions into three different tiers based on risk level. Each tier — usually called qualified, mid-qualified, and non-qualified — has its own rate. The lower the risk, the lower the fee.

Here are the pros and cons of the tiered pricing model:

- PROS: Your monthly processing statement will be easy to read. It will basically list the number of transactions that fall into each tier. If transactions fall into the qualified tier, you could pay less than you’d pay with other pricing models.

- CONS: Most solution providers quote the lowest tier (qualified) when sharing pricing. But it’s possible that you’ll have very few transactions that fall into that tier. The qualified tier is made up of standard consumer credit and debit cards. However consumer rewards cards, which are very popular, would fall into a higher priced tier. Plus, because fees are tiered, you have no transparency and no way of knowing what you are actually paying to each of the three entities involved (issuer, card network, and acquirer or processor).

Technically, you are still paying the interchange and scheme fees to their respective parties. However, with the tiered pricing model, you can’t actually see how much of the total cost goes to each entity. You’d simply be charged the tiers corresponding flat fee. Like this:

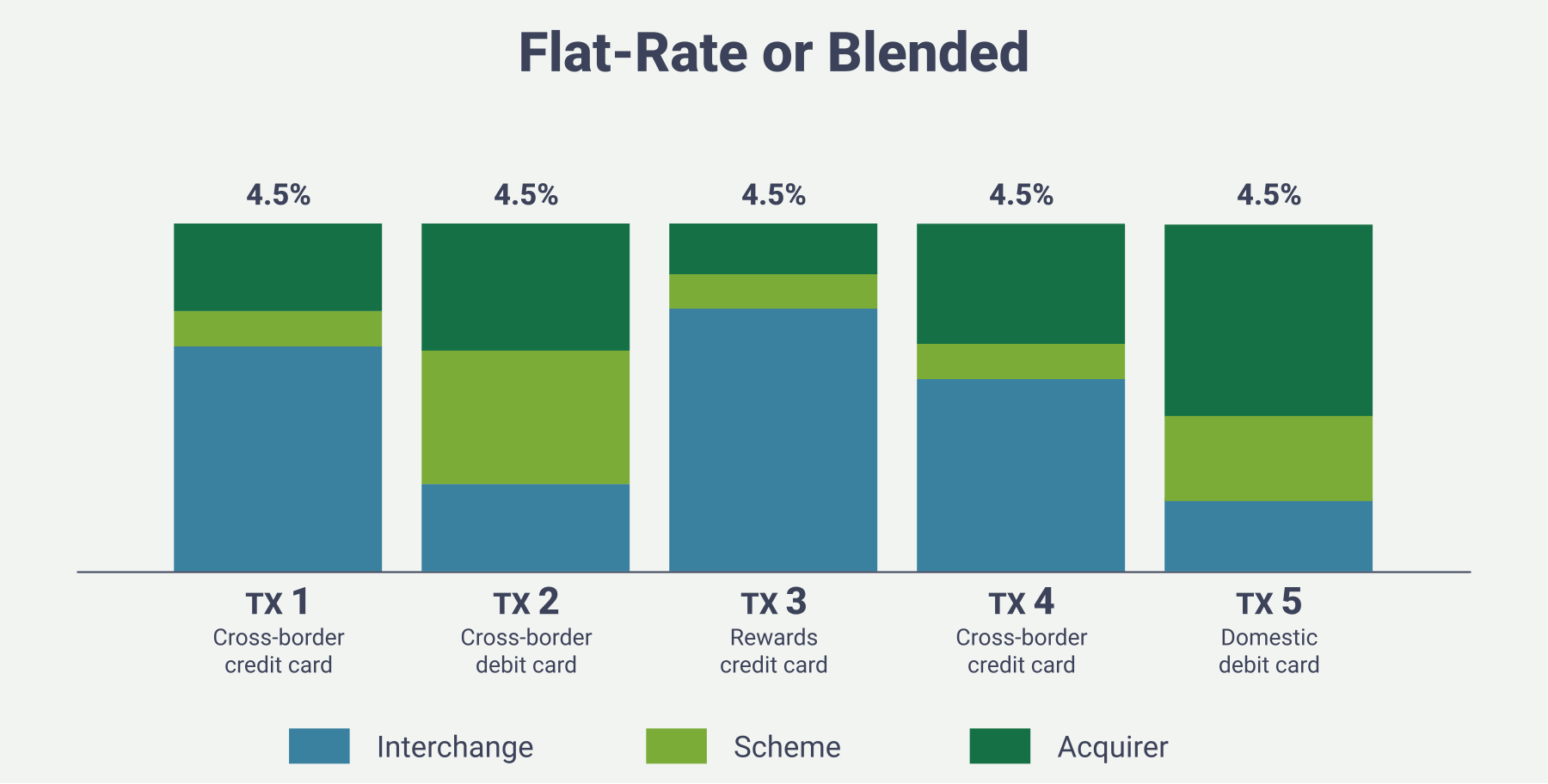

Flat-rate or blended pricing

The flat-rate or blended pricing model applies a set fee to each and every transaction — regardless of the fluctuating interchange rate.

Here are the pros and cons of the flat-rate pricing model:

- PROS: Costs are set and predictable. There are no variances to account for. Processing statements are simple and straightforward. This is a good model for small businesses that don’t have the time or desire to manage a nuanced pricing system.

- CONS: If you compare this pricing model to interchange++ and interchange+, you’ll probably pay more. With the interchange-based systems, the acquirer fee is fixed. So per-transaction costs fluctuate as interchange shifts. With the blended model, interchange still varies — but so does the acquirer rate. It adjusts to make up the difference between the interchange rate and the quoted per-transaction fee. However, when blended pricing is compared to a tiered pricing model, blended is usually comparable — if not cheaper.

Here’s what the flat-rate or blending pricing model looks like.

Debit & credit card processing fees comparison

Now that we’ve explained each of the different pricing models, let’s take a look at how they compare. Here’s what it would look like if the same five transactions were processed with each of the different pricing models.

Now, let’s run a comparison of processing fees by provider.

| All-in-one payment platform (Stripe, Shopify, etc.) | AltoPay merchant accounts | |

|---|---|---|

| Typical pricing model | Flat-rate | Interchange++ (Europe) and Interchange+ (North America) Flat-rate available upon request |

| Fee transparency | Low transparency. You pay a set amount for each transaction and have no way of knowing what gets paid to who. So the processor usually gets more than they would with other pricing strategies. | High transparency. You know exactly who and how much you pay with each transaction. The total amount you pay for each transaction will fluctuate, but you’ll always pay the same amount to AltoPay. |

| Ability to negotiate rates | There is very little — if any — flexibility in pricing. | AltoPay’s goal is to help you achieve stable, reliable payment processing — so low costs and healthy margins are essential. As your business grows and evolves, we’ll make sure you have the best pricing available. |

| Support | Support teams are usually difficult — if not impossible — to reach. Advice is general and not specific to your business. Accuracy and helpfulness is questionable. | Your dedicated support specialist will proactively identify opportunities to improve ROI and is always available to answer any questions. |

| Ideal for… | New and small businesses | Established businesses wanting to grow |

So which pricing model and provider is best?

The answer should be customized for your unique business.

But if you are an established business looking for a better payments strategy or wanting to expand globally, AltoPay is your best bet.

How to lower credit card processing fees

Processing fees can quickly eat up profits and shrink margins. So you want to keep them as low as possible. Here are a few suggestions.

- Negotiate with your processor or acquirer. If you are getting a new merchant account, check to see if there are any concessions that can be made. If you have an established merchant account and are in good standing with your provider, see if you can renegotiate pricing.

- Switch to a transparent pricing strategy. If you are currently with a processor or acquirer that has tiered or flat-rate pricing, consider switching to a provider with interchange+ or interchange++.

- Reduce chargebacks and fraud. This tip will probably have the biggest impact on pricing. If you have higher-than-normal fraud or chargeback rates, you can expect higher pricing. Try to lower your risk so you can lower your costs.

- Batch transactions daily. The longer you wait to settle transactions, the higher your processing fees.

- Choose the right billing model. One-time sales (sometimes called straight sales) have lower fees than subscriptions or recurring billing. If you can manage without subscriptions, you can save a lot of money.

Credit card processing fees by industry and region

There are a lot of variables that can impact processing fees. For example:

- Card-not-present (online) transactions cost more than card-present (in-person) transactions.

- High-risk industries and MCCs pay more than low-risk industries and MCCs.

- Acquirers in Europe use different pricing models than acquirers in the USA.

As you grow your business, it’s important to consider both potential revenue and potential financial risks. Don’t blindly jump into seemingly profitable opportunities without first understanding the costs.

The team at AltoPay would be happy to help you make these important business decisions. We have decades of experience helping businesses grow and evolve. We’d be honored to help you too. Contact our team today to get the conversation started.

Other merchant account fees explained

When thinking about the costs associated with accepting cardholder payments, the debit and credit card processing rates usually get the most attention — probably because they are the most prevalent.

But processing fees are usually just one of many fees you could be charged. There are other non-processing fees to be aware of.

Here are some additional payment-related expenses you may encounter.

- Gateway fees – A payment gateway is the platform that transmits payment information from your website to your payment processor or acquirer. It’s possible that your gateway could charge a per-transaction or monthly fee.

- Debit and credit card terminal fees – If you accept in-person payments, you’ll need a point-of-sale terminal. Terminals are usually purchased or rented for a fee.

- Hosting fees – Your website hosting company likely charges a fee.

- Third-party fraud detection fees – Screening each transaction for signs of fraud can add a per-transaction fee.

- Identity verification fees – If you use the identity verification tools provided by your processor — like Address Verification System (AVS) and card security code checks (CVV, etc.) — you’ll likely pay a fee for each screened transaction.

- Batch or settlement fees – Your acquirer might charge a fee for settling your batch of payments each day.

- Chargeback fees – You will likely be charged a fee for every chargeback you receive.

- Monitoring program fees – Acquirers and card brands monitor your fraud and chargeback activity. If rates get too high, you could be enrolled in a monitoring program (like VAMP). Fees are usually charged per case or as a monthly fine.

- Statement or support fees – Some acquirers and processors charge a monthly fee for support-related services.

- Minimum fees – You might have to pay a monthly fee if you don’t meet minimum volume requirements.

How to calculate your effective processing rate

Payment processing fees are a complex topic. However, it’s important to fully understand what you are paying so you know how to protect your margins.

Here’s one way to simplify the complexities while maintaining a clear understanding of costs: calculate your effective processing rate.

Your effective processing rate compares the total amount you pay in processing fees to your total amount of credit and debit card sales.

Here’s how to calculate your effective processing rate:

- Gather your most recent monthly processing statement from each acquirer.

- Add together all the fees listed on your statement (interchange fees, settlement fees, chargeback fees, — everything!).

- Add together all your payment card sale amounts — debit, credit, pre-paid, etc.

- Complete the following calculation: effective rate = (total fees / total sales) x 100

- Repeat this process for each merchant account.

For example, if you pay $5,000 in fees to process $100,000 in sales, your effective rate is 5%.

Why an effective rate matters

There are several reasons why you’d want to calculate your effective rate.

- You can look at big picture spending versus individual transaction costs. Focus on cutting the costs that have the biggest impact on your bottom line instead of shaving pennies off each transaction.

- You might uncover hidden costs. If you are only focused on transaction-level processing fees, you might overlook account-level fees like a PCI compliance fee or daily settlement fees.

- You can accurately monitor ROI. Understanding total costs can help ensure you are pricing your goods and services correctly.

- You can easily compare profits on a per-account basis and make adjustments as needed. For example, one acquirer might have a better effective rate than another — whether that is because costs are lower or authorization rates are higher. These insights can help you shift processing volume to the most profitable option.

Frequently asked questions about merchant pricing

What are merchant account fees?

Merchant account fees are the fees you pay to maintain a merchant account and use it to process credit and debit card payments.

The most well-known merchant account fees are the payment processing fees — the fees associated with completing a payment card transaction. Payment processing fees are divided into three categories and go to three different entities in the payments ecosystem. Interchange fees are paid to issuers, scheme fees are paid to the card brands, and acquirer fees are paid to your merchant account provider.

In addition to processing fees, you may have to pay other account fees such as monthly minimums and chargeback fees. Check your merchant agreement to learn more about what you do and don’t have to pay.

Is the processing fee for credit cards different from debit cards?

Yes. Processing fees are usually higher for credit cards than debit cards.

The reason is because credit cards have higher interchange rates.

Issuing banks take on more risk when they issue credit cards. With a credit card, funds are loaned to cardholders and must be paid back. With a debit card, funds are withdrawn from an account. Plus, credit cards often have rewards programs that come with additional costs for issuers.

Interchange compensates for these additional risks and costs.

Does debit and credit card processing pricing differ by country?

Yes and no.

If you use a single merchant account to process payments in multiple countries, your acquirer fee will probably remain the same regardless of where the card was issued.

But interchange rates are set by country, and there can be significant differences from one region to the next.

What are typical credit card processing fees?

Unfortunately, there is no universal pricing guide. Pricing can vary by country, merchant, and even transaction.

Here are a couple of generic guidelines:

- Interchange and scheme fees typically comprise the largest portion of your total processing fees.

- Businesses that have low-risk MCCs and traditional merchant accounts traditionally pay less than high-risk merchant accounts.

- Transactions processed with a debit card traditionally cost less than transactions processed with a credit card.

Do different industries have different merchant card fees?

Yes. A business that is classified as low-risk will pay less in processing fees. Industries and MCCs that are considered high-risk trigger higher processing fees.

For more than a decade, Jessica Velasco has been a thought leader in the payments industry. She aims to provide readers with valuable, easy-to-understand resources.