How do you build a chargeback prevention strategy with Order Insight, Ethoca prevention alerts, Verifi CDRN, and Rapid Dispute Resolution (RDR)? Do the different solutions compete with each other? Or does using multiple solutions create more protection?

Let’s find out.

HIGH-LEVEL OVERVIEW

Order Insight defined

Order Insight is a real-time communication channel connecting you, the merchant, with the cardholder’s issuing bank. Because you have a direct line of communication, you can work together to resolve disputes before they become chargebacks.

This open communication is important. Often, customers will contact their bank when they have questions about a purchase.

- I don’t remember making this purchase. Why was my account debited?

- I cancelled my subscription. Why was I still charged?

- My order hasn’t been delivered. When will it arrive?

But banks don’t typically have the insights needed to answer those questions.

That’s why Verifi, a Visa company, introduced Order Insight.

When a cardholder contacts an issuer with questions, the issuer can ping you via Order Insight to request clarifying information. The information you provide the bank can help explain the purchase — product descriptions, shipping information, refund status, terms and conditions, etc.

The bank can use the information provided to clarify the cardholder’s concerns and hopefully talk off the dispute — without the need for a chargeback.

RELATED READING

HIGH-LEVEL OVERVIEW

Prevention alerts and prevention RDR defined

Alerts and RDR are dispute resolution solutions that prevent chargebacks by refunding transactions.

If you refund a disputed transaction, there is no need for a chargeback.

Prevention alerts and prevention RDR achieve the same outcome, but the way they go about doing it is slightly different.

- Prevention alerts: When a cardholder disputes a transaction, the issuer can send an alert instead of a chargeback. You (or your solution provider) will receive the alert, issue a refund, and respond to the alert. This can be done manually or with automation.

- Prevention RDR: When a cardholder disputes a transaction, RDR can intercept the case before it becomes a chargeback. If your pre-set rules apply, Visa will refund the transaction (if rules don’t apply, no refund will be issued and the dispute will advance to a chargeback). The RDR process is entirely automated.

RELATED READING

PUTTING IT TOGETHER

Creating a multi-layer chargeback strategy

How do these solutions work together?

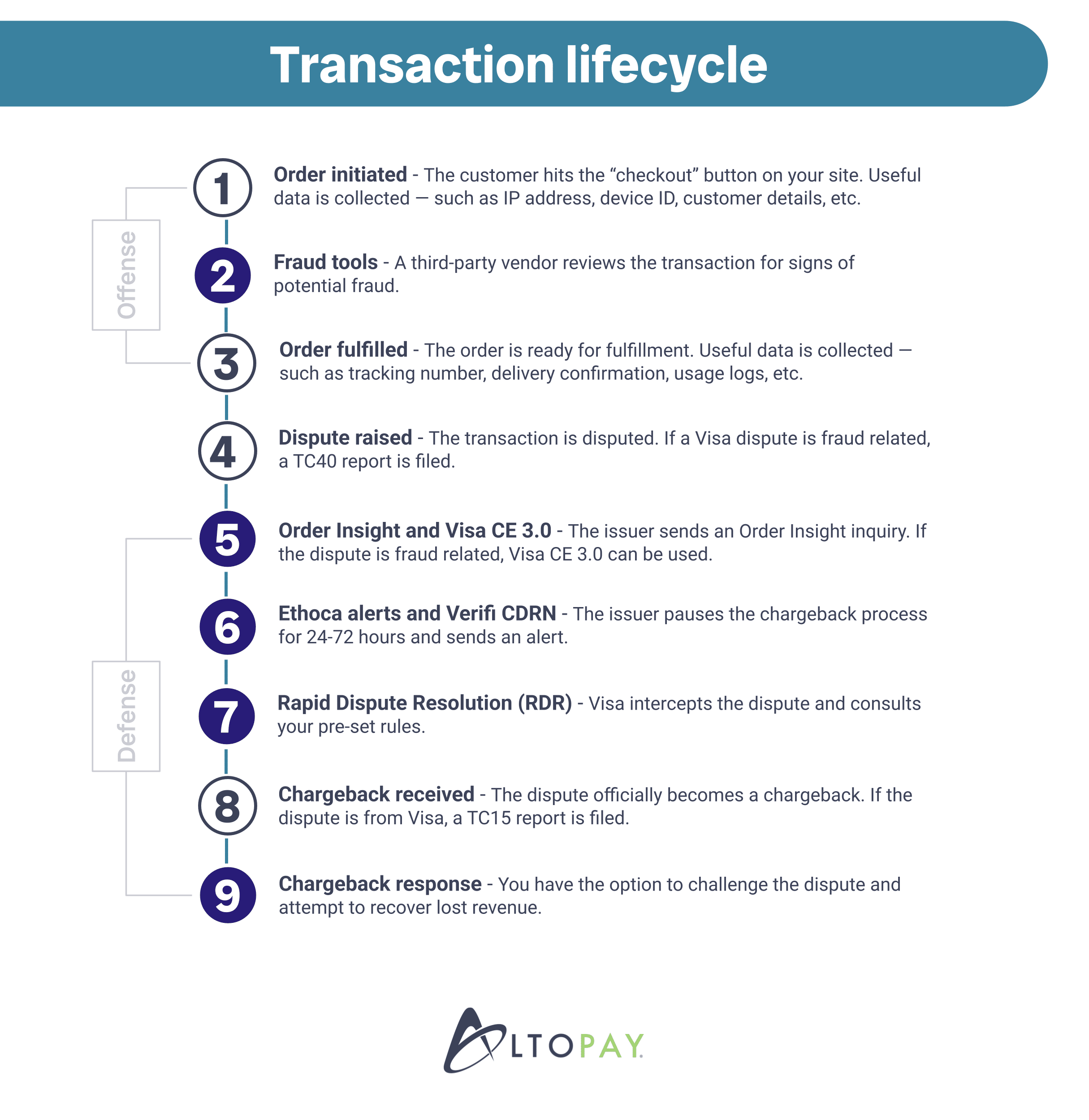

Chargeback management solutions can be inserted at various places in the nine-step transaction lifecycle.

Collectively, these solutions can be used to build a chargeback management workflow. Not all solutions will be used for all cases — the workflow is a series of if/then situations that move the case down the path of resolution.

Some chargeback management solutions are brand specific — meaning they will only work for Visa or Mastercard but not both. Other solutions are agnostic, so you can use them for both brands.

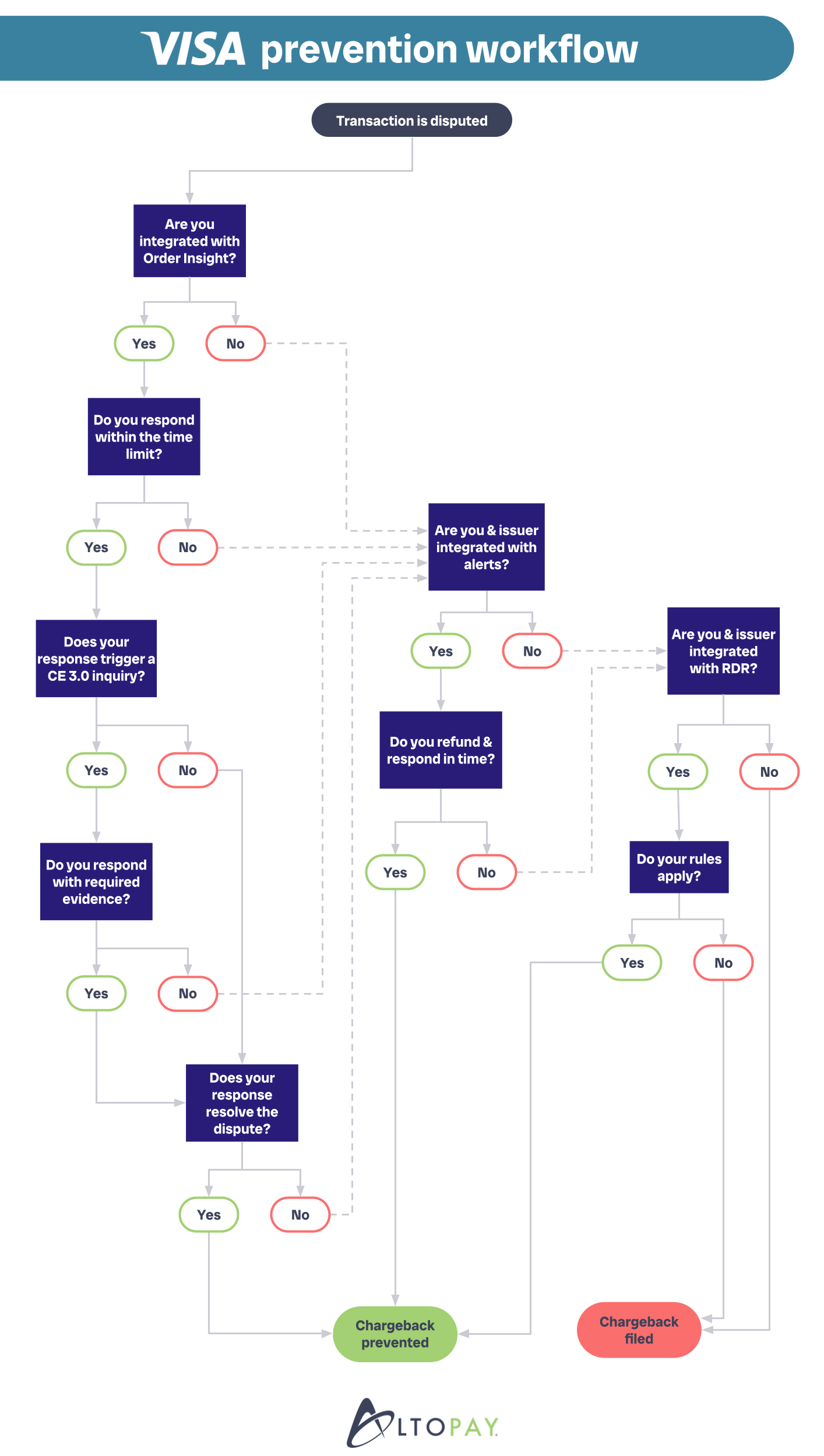

Visa prevention flow

Let’s take a look at the Visa workflow that incorporates some of the most common solutions — Order Insight, Visa CE 3.0, prevention alerts, and Rapid Dispute Resolution (RDR).

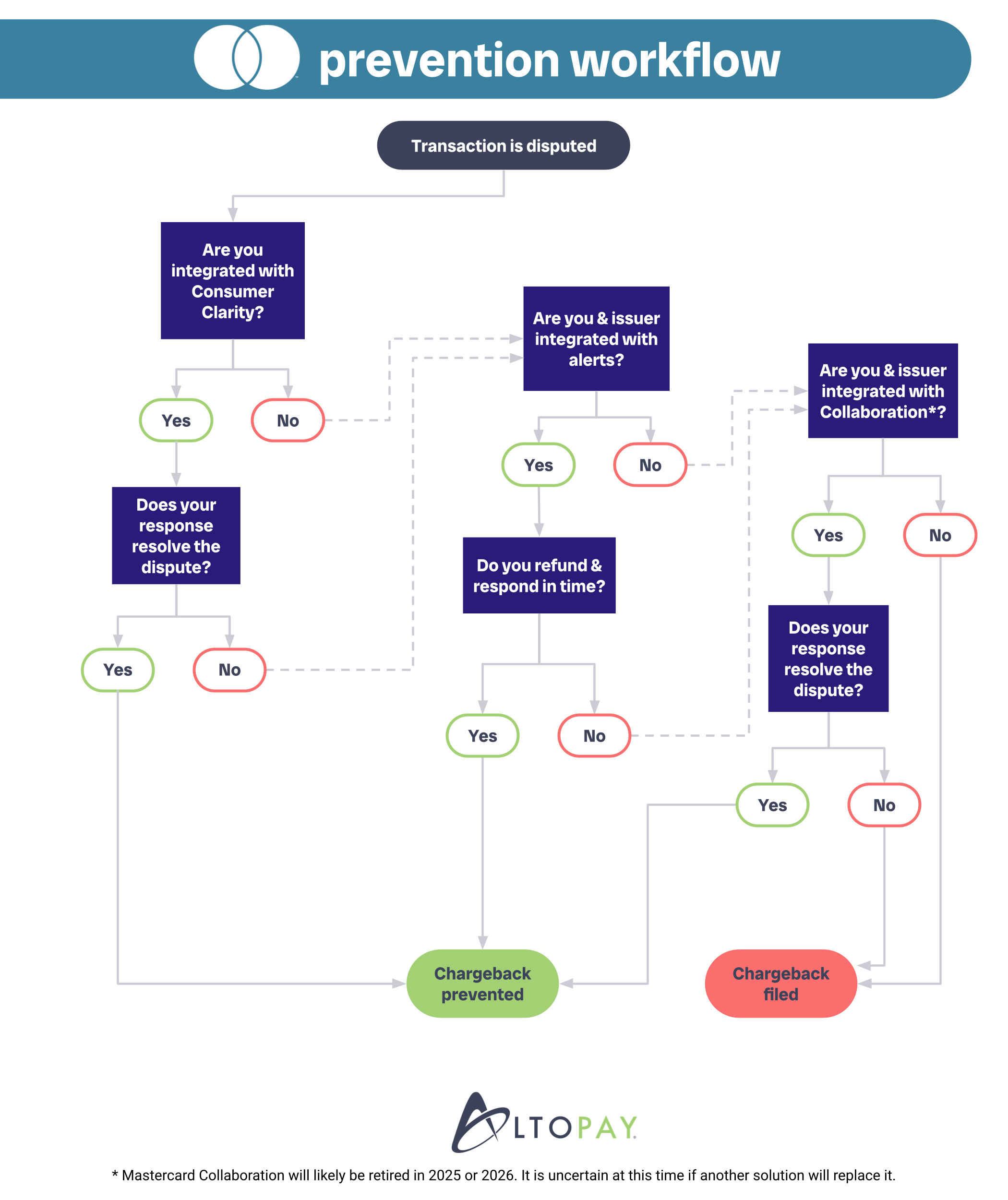

Mastercard prevention flow

Mastercard prevention solutions are similar to Visa’s.

- Consumer Clarity is similar to Order Insight

- Collaboration is similar to Rapid Dispute Resolution

Here’s an overview of the Mastercard workflow.

PROS AND CONS

Should you use multiple solutions?

Typically, we do recommend merchants use a multi-layer strategy for chargeback prevention.

- Manage disputes from both Visa and Mastercard.

- Get regional and international protection.

- Resolve both fraud and non-fraud disputes.

- Let one solution’s strengths compensate for another solution’s weaknesses.

To get the best results possible, let our team guide you in the strategy-building process. We’ll help you determine which solutions would be best for your business and how to manage them to optimize outcomes.

To learn more, contact the AltoPay team today.

AUTHOR

Jessica Velasco

For more than a decade, Jessica Velasco has been a thought leader in the payments industry. She aims to provide readers with valuable, easy-to-understand resources.