Order Insight is a valuable chargeback prevention tool. Check out our detailed guide to learn how the solution works, how much it costs, and if it would be a good fit for your business.

What is Order Insight?

Order Insight is a real-time communication channel connecting you, the merchant, with the cardholder’s issuing bank.This direct line of communication allows you to work together to resolve disputes before they become chargebacks.

A lot of chargebacks are filed because of confusion or a lack of understanding.

I don’t recognize this business name. What was this purchase for?

I requested a refund. Has it been issued yet?

I haven’t received my order. When will it be delivered?

In a perfect world, cardholders would bring these questions to you. But as we know, that doesn’t always happen. Oftentimes, cardholders will contact their issuing bank with concerns. But issuing banks have access to very limited information and can’t provide helpful insights.

So if neither the cardholder nor the bank can figure out what’s happening, the next step is usually to file a chargeback — even if the purchase was totally legitimate and being handled in the appropriate way.

To address this shortage of information and abundance of unnecessary chargebacks, Verifi (a Visa company) created Order Insight.

Order Insight gives issuing banks information they couldn’t otherwise access. It basically turns the issuing bank into an extension of your in-house support team, empowering the issuer to navigate issues on your behalf.

When a cardholder contacts the bank about a confusing purchase, the bank can use Order Insight to contact you in real time and obtain clarifying information. The information provided hopefully helps the cardholder better understand the purchase so a chargeback isn’t needed.

Why would I use Order Insight?

What are the benefits of Order Insight? Why would you add this solution to your chargeback prevention strategy?

Here is a high-level overview of what you could gain.

- Reduce your chargeback ratio. If you can resolve a dispute before it progresses to a chargeback, you can protect your chargeback-to-transaction ratio. And maintaining a respectable ratio is important. If your chargeback activity breaches your bank’s set limit, your merchant account may be closed.

- Save your revenue. Other chargeback prevention solutions resolve disputes by issuing refunds. But Order Insight doesn’t require a refund to be successful. So you can prevent the chargeback and retain your revenue, which means Order Insight could have a high return on investment.

- Solve problems quicker. When a chargeback is filed, it could take 2-5 weeks for the notice to reach your business. A lot of additional transactions can be disputed in that time. But Order Insight happens in real time, so you know about issues immediately. Use the advance notice to solve the underlying problems that are causing the disputes and stop additional chargebacks from happening.

- Retain the cost of goods. If a fraudster makes an unauthorized purchase and you are promptly notified of the dispute via Order Insight, you might be able to stop order fulfillment before your valuable merchandise is shipped out.

- Automate dispute resolution. Order Insight is an automated solution. Information is requested and passed to the issuing bank via an API. You don’t need to be involved in the resolution process.

- Stop more fraud chargebacks. Order Insight is part of the new Visa CE 3.0 solution. If you respond to inquiries with specific customer information, you can stop invalid fraud claims and protect your VAMP ratio — guaranteed.

How does Order Insight work?

Issuing banks can ping you via Order Insight to request clarifying information when a cardholder raises concerns about a purchase. You can respond in real time with information that will help clear up any confusion.

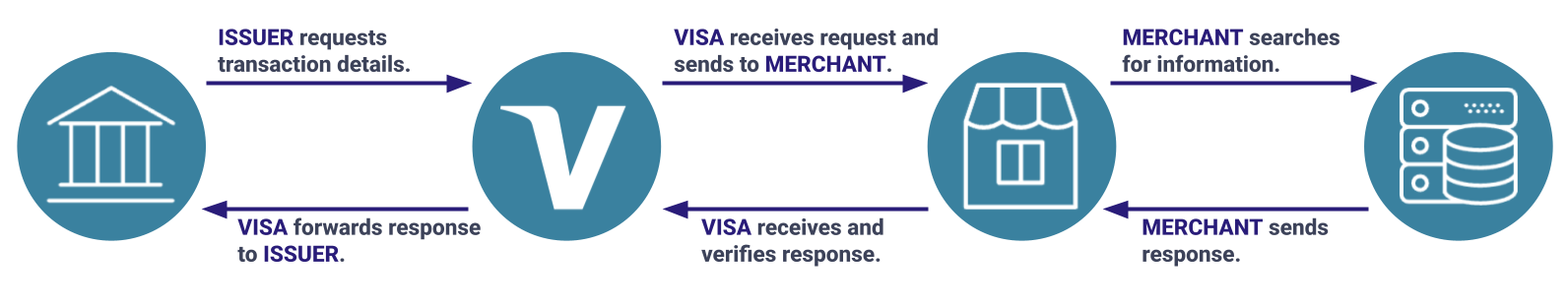

It works like this:

STEP #1: The cardholder questions a transaction and launches an Order Insight inquiry. This can happen either via a button in the online banking app or by calling the bank’s customer support number.

STEP #2: The issuer sends the inquiry to Visa.

STEP #3: Visa sends the inquiry to you or a service provider acting on your behalf (like AltoPay).

STEP #4: The inquiry is received, information is collected, and a response is sent. This happens in two seconds or less.

STEP #5: Visa receives the information.

STEP #6: Visa forwards the information to the cardholder via the issuer.

STEP #7: The information helps clarify the transaction and a chargeback is no longer necessary.

A high-level overview of the flow looks like this:

NOTE

When it first launched, Order Insight offered two integration options: one to pass static data and one to pass dynamic data.

Static data is standard business details that are applicable to any Order Insight inquiry — such as the business’s name, customer service phone number, terms and conditions, website, and return policy.

Dynamic data is transaction-specific data that changes with every Order Insight inquiry — such as customer information, delivery details, and a description of what was purchased.

Dynamic data is more robust and has a better chance of resolving disputes. However, it involves a fairly detailed integration process.

In an attempt to make the solution more relevant to businesses with low or no tech capabilities, a static integration option was made available.

However, Verifi is in the process of updating tech requirements, and the static integration option is being sunsetted.

Allegedly, by the end of 2025, any merchant interested in using Order Insight will need to complete the API development work and respond to inquiries in two seconds or less with dynamic data.

What information does Order Insight share?

Order Insight uses information to resolve payment disputes. But what type of information?

The Order Insight API can pass hundreds of different data points. Data is organized into different objects.

The purchase receipt object includes information such as:

- The order date and number

- A description of what was purchased (services or merchandise)

- The transaction amount itemizing tax and shipping

The payment information object includes information such as:

- The billing name and address

- The payment method and account number

- CVV approval or decline codes

The purchased product object outlines each item purchased and includes information such as:

- A description of the item that was purchased

- A direct URL for the product description on your website

- The price of the item and the number of items purchased

The customer information object includes information such as:

- The customer’s full name

- The customer’s email address

- How long the customer has had a relationship with you

- The account ID or unique identifier the customer created for themself

The merchant information object includes information such as:

- The name of your business

- Your website, address, and customer service phone number

- Your terms and conditions

The delivery details object includes information such as:

- The shipping carrier and tracking number

- The dates the item was shipped and delivered

The device information object includes information such as:

- The name the customer has given their device (device name)

- The unique identifier assigned to the device (device ID)

- The unique identifier you’ve given the customer’s device (device fingerprint)

- The device’s IP address

There is also the opportunity to share industry-specific information including:

- Flight details

- Hotel details

- Car rental details

- Ride share details

Check our blog article for a complete listing of OI information options and API details.

RELATED READING

What is the success rate for Order Insight?

There are a lot of factors that can impact the success rate of Order Insight.

- The type and amount of information you share

- Your most common reasons for disputes

- The type of goods or services you sell

In many cases, it can be challenging to judge effectiveness.

For example, you may look at a list of Order Insight cases and find that a significant portion don’t have corresponding chargebacks. On the surface, it may seem like Order Insight successfully resolved those disputes. However, it’s impossible to know whether or not the Order Insight data influenced the issuer’s decision to file a chargeback. The issuer might have simply decided it wasn’t cost effective to proceed.

In general, our data shows that Order Insight typically has a 5-10% net effect on chargeback rates.

But again, results can vary significantly by business. If you are interested in adding Order Insight to your chargeback management strategy, let us know. We can do an analysis for your business and give you a more personalized estimate for results.

How do I know if Order Insight is a good fit for my business?

There are hundreds of nuances that can go into a strategy that reduces chargebacks. Is Order Insight right for your business?

Order Insight could benefit any online business with access to the development resources needed to complete the integration.

The results might not be as impressive as other prevention solutions. However, the ROI can be quite compelling — for a couple of reasons.

- You don’t have to issue a refund, so you retain more revenue.

- The per-case fee is significantly lower than other chargeback prevention solutions.

Plus, if you access Order Insight via an integrated partner, you don’t have to bother with the development work.

RELATED READING

What is the difference between Order Insight, prevention alerts, and prevention RDR?

There are several different solutions on the market today that can help prevent chargebacks. Here are some of the most commonly used solutions:

All can help resolve disputes before they become chargebacks — but the way they go about doing it varies slightly.

Here’s a high-level overview.

Solution provider

Prevention Alerts

You can receive alerts directly from the vendor or from a solution provider.

RDR

You can receive RDR directly from your acquirer or via a solution provider.

Process

Prevention Alerts

The cardholder’s bank issues an alert. Your solution provider receives the alert. You or your solution provider issues a refund and responds within 24-72 hours.

RDR

The cardholder’s bank initiates RDR. Your acquiring bank receives the RDR case and consults your pre-set rules. If rules apply, the acquirer issues a real-time refund.

Rules

Prevention Alerts

You decide on a case by case basis what should and shouldn’t be refunded.

RDR

You set rules for what should and shouldn’t be refunded. For example, all disputes with reason code 10.4 or anything under $50.

Source

Prevention Alerts

You or your solution provider manages refunds in your CRM or order management system.

RDR

Your acquirer refunds disputes directly from your merchant account.

Automation

Prevention Alerts

Some solution providers can automate the process – such as locating the disputed transaction in your CRM, issuing the refund, and responding to the alert.

RDR

Your acquirer can automatically issue a refund.

Results

Prevention Alerts

Prevention alerts typically prevent 30-40% of all chargebacks. Results improve as more banks adopt the technology.

RDR

Because RDR is integrated with all Visa issuers, the product is technically capable of preventing all chargebacks if you set your rules to refund everything. However, some banks haven’t fully adopted RDR, so results are usually around 90%.

Reconciliation

Prevention Alerts

Since refunds are managed in your CRM or order management system, no additional reconciliation tasks are required.

RDR

Since refunds are managed through your merchant account, you need to update your CRM to note the dispute and refund.

Check our detailed blog article for more information, including a flow chart that shows how these three solutions can fit together into a comprehensive chargeback prevention strategy.

You’ll also want to learn how Order Insight fits into another chargeback prevention solution — Visa CE 3.0.

RELATED READING

What is the price for Order Insight?

Like most other prevention solutions, Order Insight charges a fee for each prevention case. But unlike other prevention solutions, the cost for Order Insight is much less — roughly the same as a gateway fee.

There are a couple stipulations to be aware of when it comes to pricing. Check our OI pricing article to learn more.

RELATED READING

Next steps

If you are ready to get started with Order Insight, let us know. We’ll review your current business setup and any integration requirements.

If you’re still trying to decide if Order Insight is a good fit for your business, check our additional resources.

For more than a decade, Jessica Velasco has been a thought leader in the payments industry. She aims to provide readers with valuable, easy-to-understand resources.